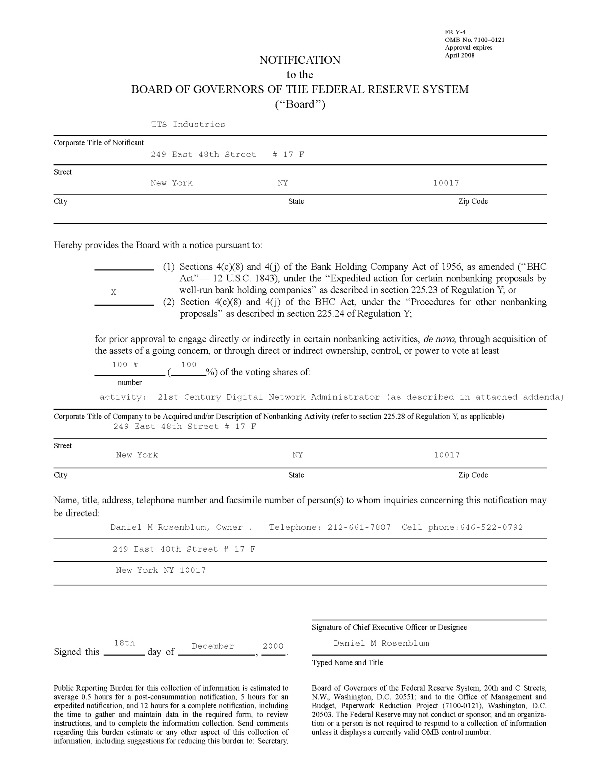

-v- under the ‘‘Procedures for other nonbanking

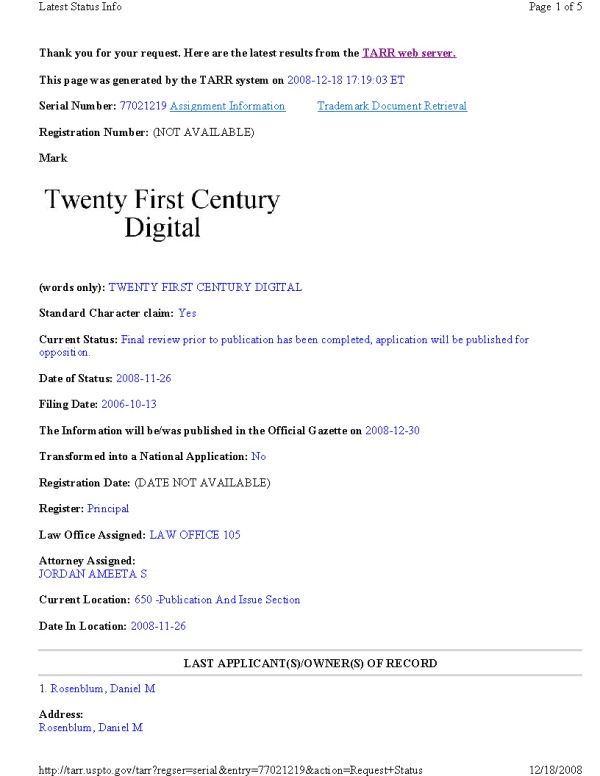

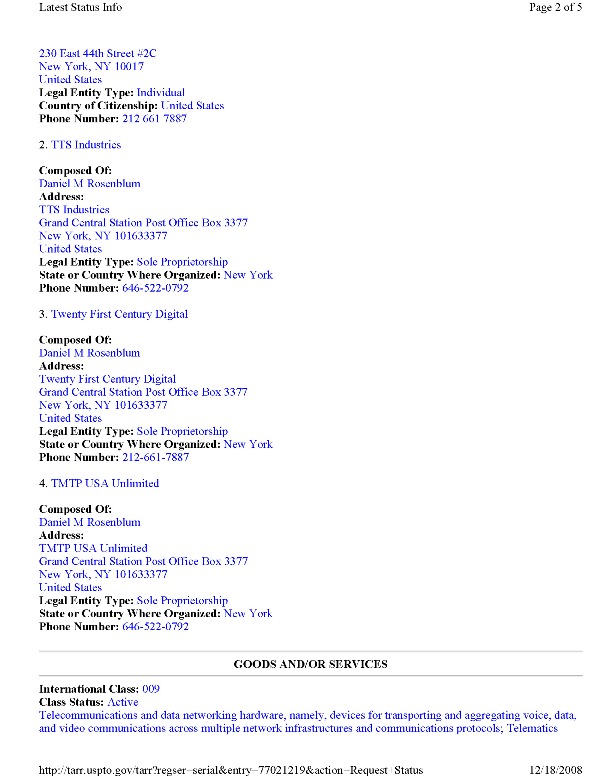

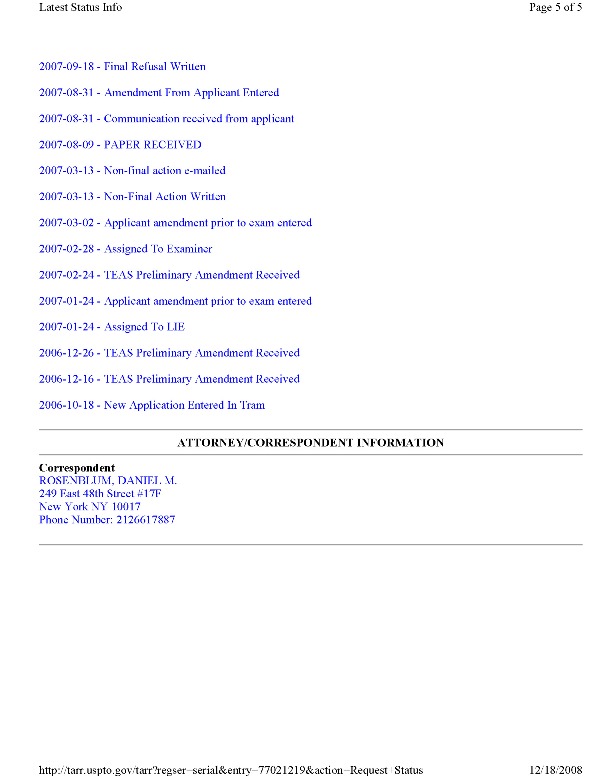

DANIEL M ROSENBLUM proposals’’ as described in section 225.24 of Regulation Y

-v- under the ‘‘Procedures for other nonbanking

DANIEL M ROSENBLUM proposals’’ as described in section 225.24 of Regulation Y

Plaintiff attorney of record Jaffe & Asher action commenced March 2011

Amex card 371339213796009

....AS AN APPENDIX TO MY INFORMATIONAL SUPPLEMENT IN ANSWER TO THE ABOVE CAPTIONED MATTERS, SUBMITTED BY DEFENDANT DANIEL M ROSENBLUM ("I", "ROSENBLUM" and "DMR" below.)

___________________________________

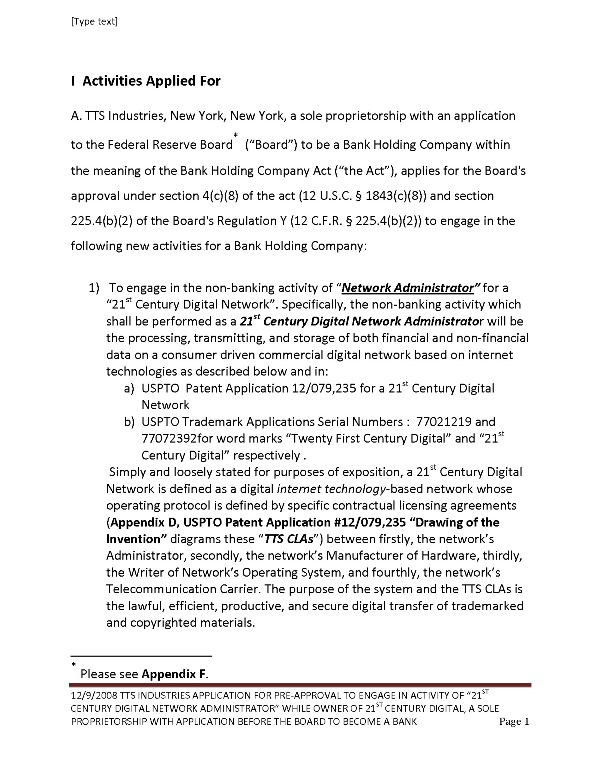

1. Commercially, a non banking entity could very well function as such data processor, once the money to be processed has left the bank as a withdrawal the bank in theory could have no revenues associated with such monies. Throughout history such has been the case. The sole function of the bank should be to encourage customers to leave money in the bank on deposit. In one scenario, highly compatible with history, is that once the money is leaving the bank, the bank should have no earning on the such money. The data processor would have the power of the market to offer enhanced digital data processing which the bank simply does not have the incentive to offer given the additional rules of banking and the incentive to maximize banking profit while earning revenues from processing the monies following the "withdrawal" . Defendant Rosenblum realizes that such matters cannot be tried in the instant matter; however, there is a direct relationship between the attorneys in this matter and the stymieing of law and regulation and advancement in the very same field. This instant matter yes does relate to the behavior and filings of attorneys in this matter as laid out below. Note that the behavior of the attorneys is one of two strands for which the instant matter should be tolled indefinitely until such matters are resolved.

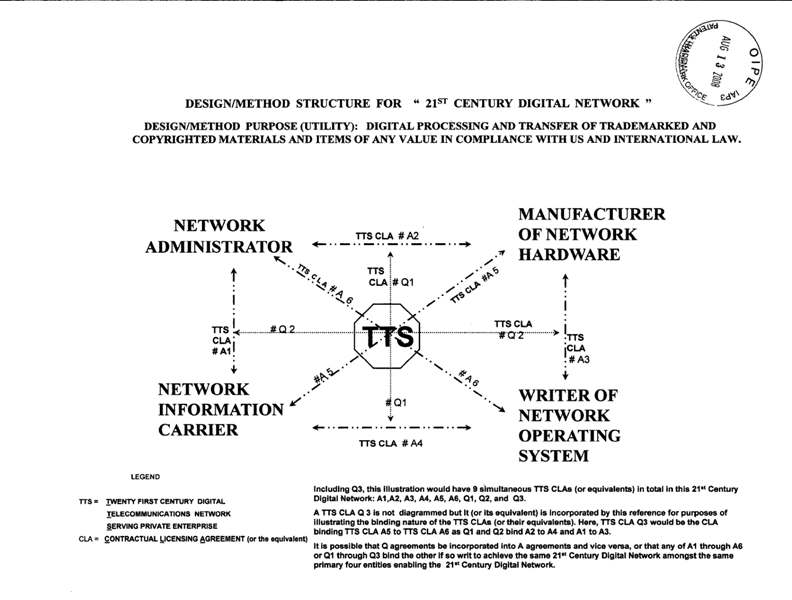

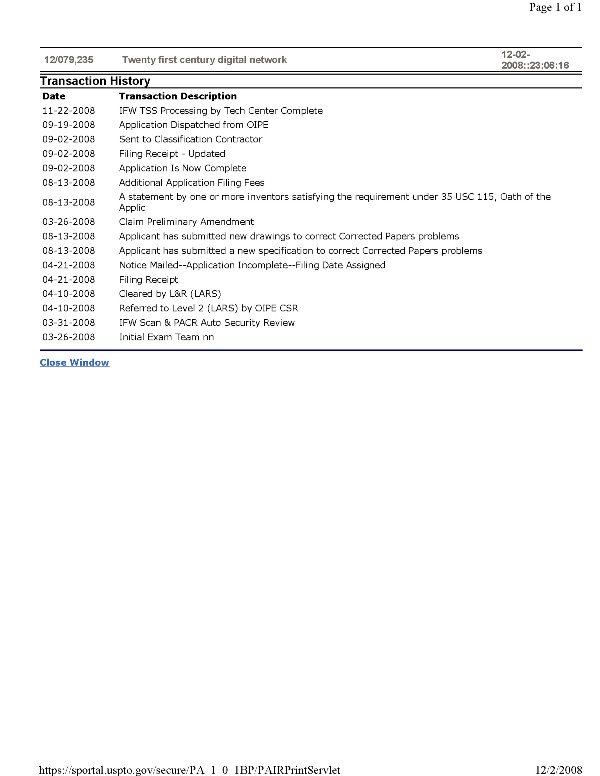

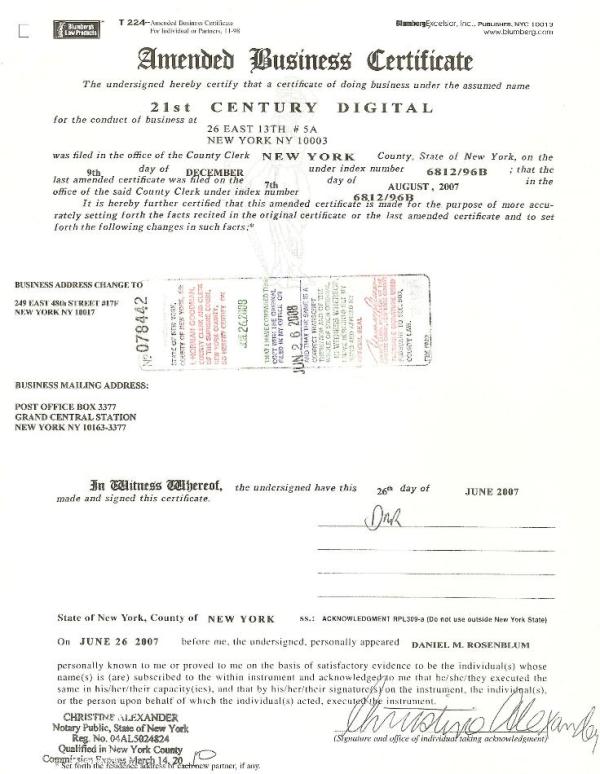

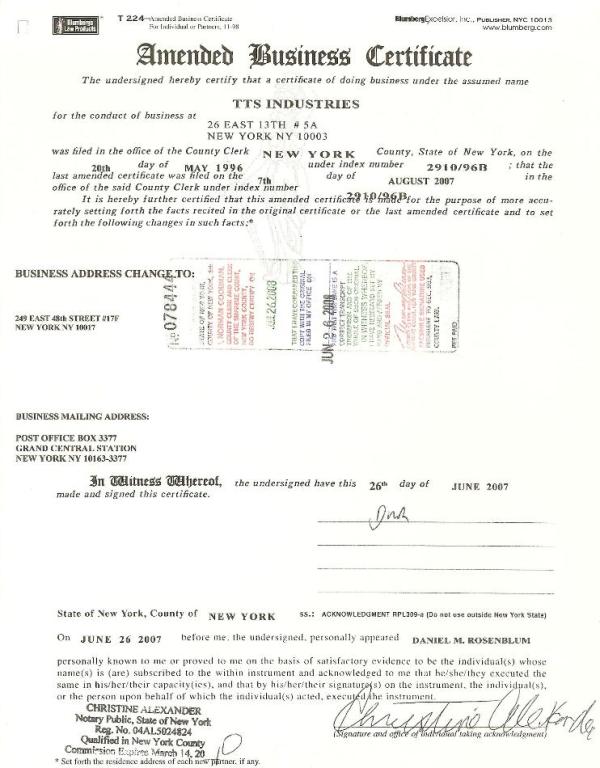

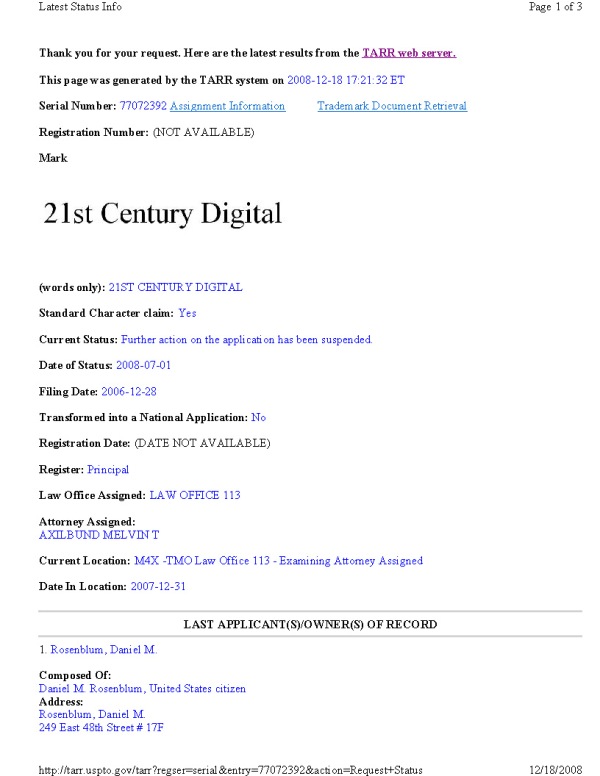

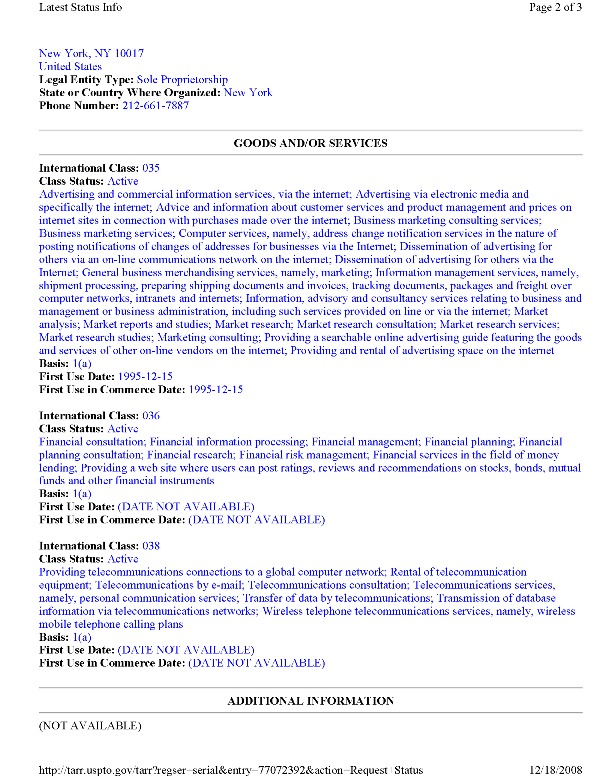

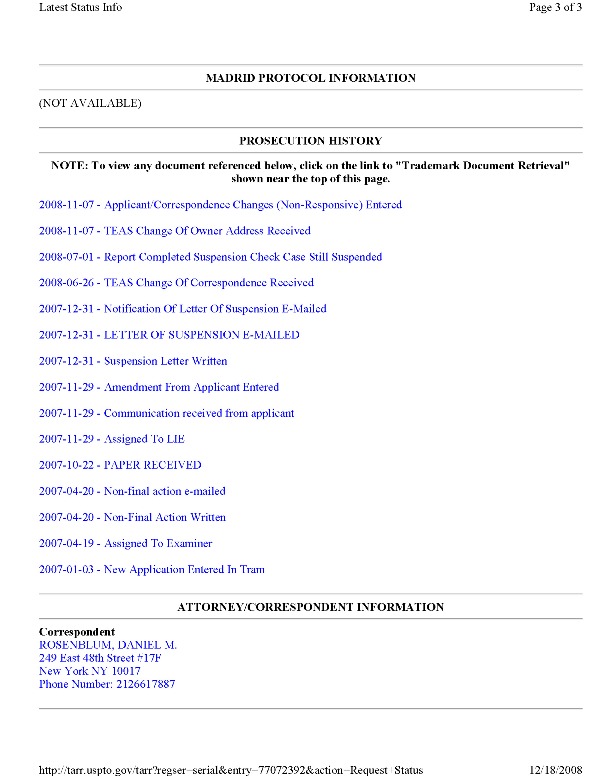

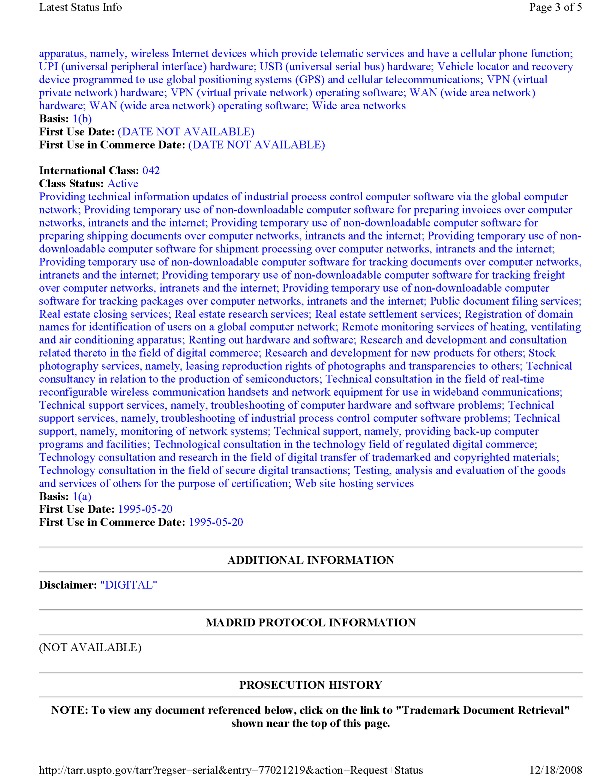

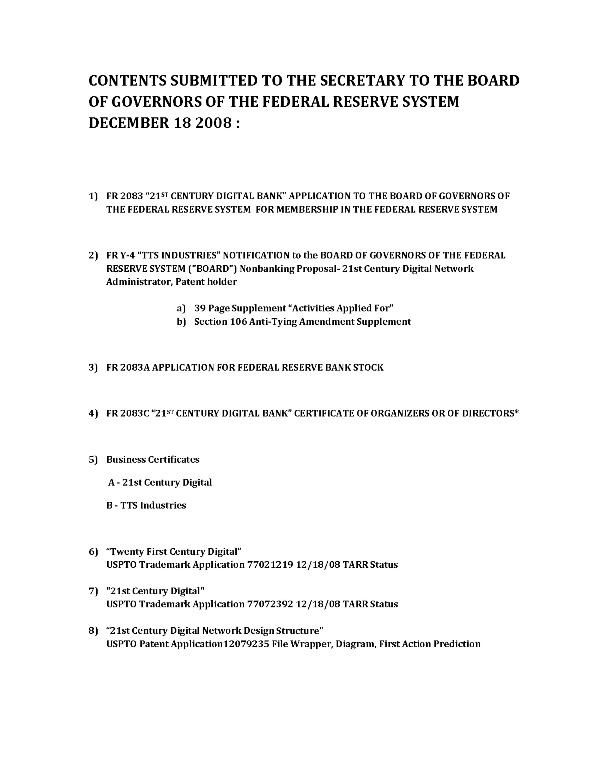

2. Section 4(c)(8) and 4( j) of the BHC Act, under the ‘‘Procedures for other nonbanking proposals’’ as described in section 225.24 of Regulation Y ;;;;images of a proposal/application are below