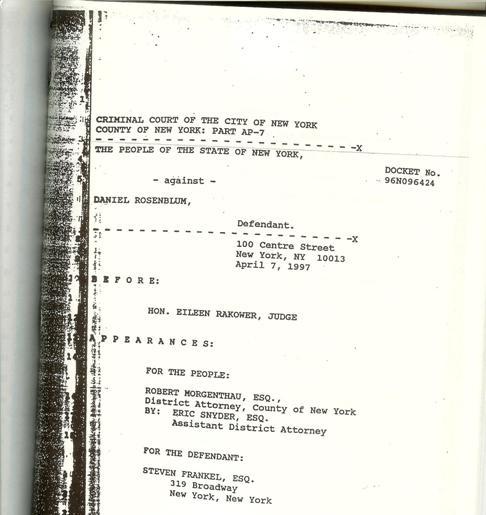

THE MATTER OF PEOPLE V DANIEL M. ROSENBLUM, MANHATTAN CRIMINAL COURT DOCKET # 96NO96424, 12/6/1996 - 4/5/1999

(This webpage is published by Daniel M Rosenblum, owner of this website www.twentyfirstcenturydigital.com. This page is published as supplement to webpage http://www.twentyfirstcenturydigital.com/TTSMay1996toMay2012.php, a 16th Anniversary Commemorative Webpage for TTS Industries. Please note this page is a work in progress. I, Dan, have written much of the below in first person narrative. I have published this page for many reasons, not the least of which is to fill in 'gaps' to friends, family, colleagues, and associates about my arrest in December 1996 on an allegation of Felony Grand Larceny based on a statement made by a Citibank Branch Manager to NYPD; how the charges were dismissed in April 1999, and how I was very dissatisfied both with the statement by the Citibank Branch Manager as well as the the manner I was represented by an attorney in the matter. As per below, I have long felt that the attorney utilized an unauthorized defense which worked to my disadvantage. I rarely verbally discuss the matters discussed in writing on this page.)

(11/30/2012: additional note to the reader: I apologize that some of my writing below is not as concise as it could be, and it is certain that editing is necessary. These days I am working full time delivering shower door glass Monday through Friday, and, on the weekends I have been able to line up clean-up work from Hurricane Sandy on Fire Island. In due course I will edit the below content. Although it needs editing, an accurate story is recounted below. There are images below of original account statements, and original transcripts and related documents, which can be reviewed quickly by scrolling down or clicking on the links. The accompanying writing is generally explanatory, providing the history associated with the documents. This is a work in progress, in the years to come I will edit etc. Thanks, ~ Dan)

The calendar week after Thanksgiving always reminds me of the December day in 1996 eight days following Thanksgiving that I was accused by Citibank N.A. of Felony Grand Larceny.

In 1996, that was Friday, December 6th, which was the same day the worldwide press was reporting Alan Greenspan's December 5th 1996 speech declaring the dot-com bubble as "irrational exhuberance" (many people remember what they were doing the day the Alan Greenspan utterance "irrational exhuberance" was made famous.

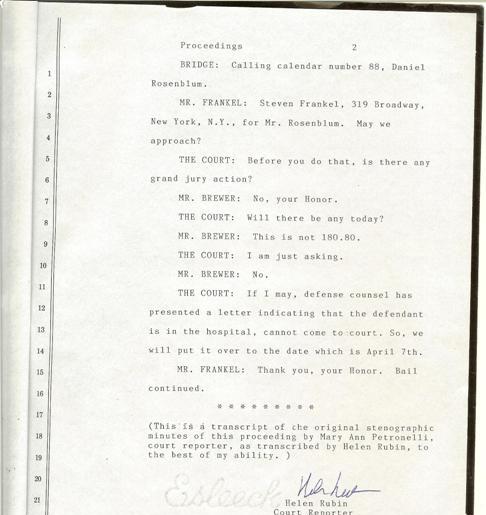

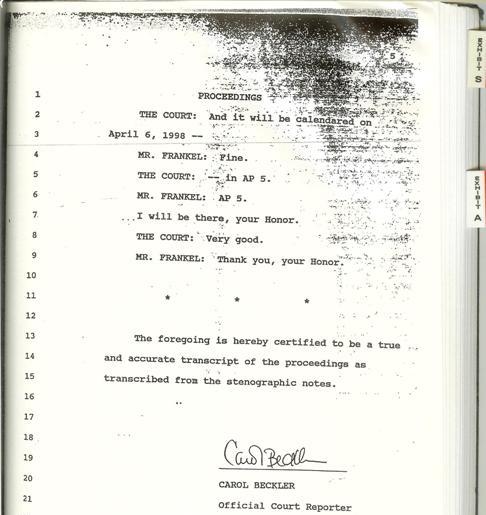

On that day, I was being processed on an allegation of Felony Grand Larceny at the 17th Precinct in Manhattan on 50th Street at 3rd Avenue. The Citibank where I was arrested, the same Citibank I opened my account at, and where I made my withdrawal the day before is two blocks away, at 48th Street on 3rd Avenue. The Felony Grand Larceny allegation was dismissed in its entirety in Manhattan Criminal Court on April 5th 1999 by Judge Ellen Coin (click for a transcript of dismissal proceedings and my 4/5/1999 filing).The purpose of this webpage is to give a rough sketch and documentation of some important facets of the debacle which was the Citibank allegation of Felony Grand Larceny and the mishandling of my defense by attorney Steven K. Frankel of the law firm Frankel Rudder and Lowery.

Additional details are contained in other webpages on my website. I rarely discuss some of the below items, but feel that it is necessary to to memorialize all facets in at least one public place on the web. Specifically, below I address the debacle of how the docket was handled by an attorney hired to represent me. It has always been my contention that the attorney mishandled the case, and that the attorney directly and deliberately put forth an unauthorized defense which, although one can argue had the direct effect of resulting in a dismissal of all allegations, also had myriad extremely negative effects. The attorney deliberately and directly ignored my direct instructions and deliberately and directly put forth an unauthorized defense, a matter which continues to date unresolved 16 years later, described in part below.

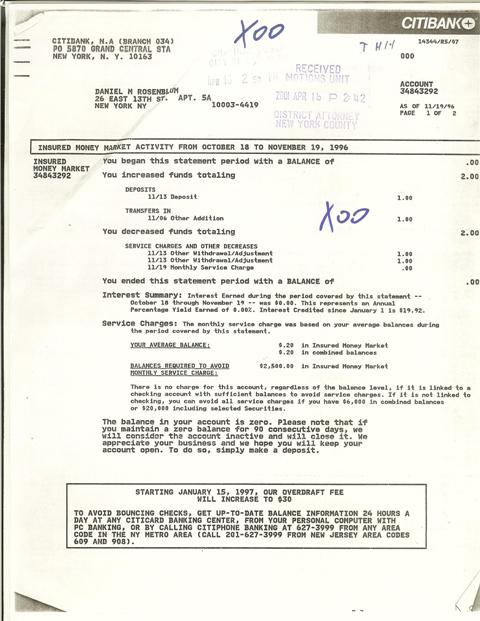

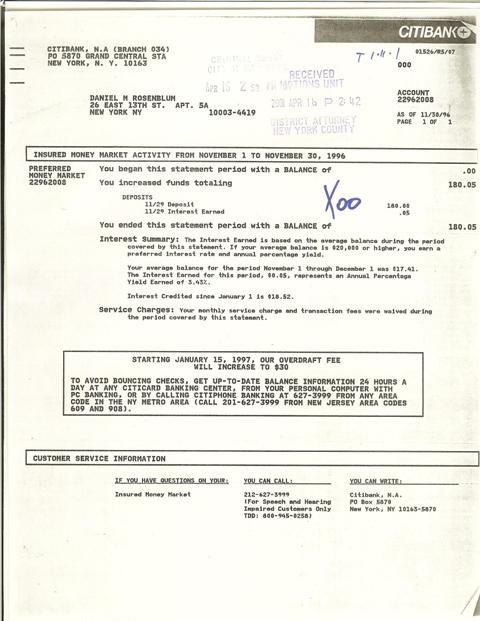

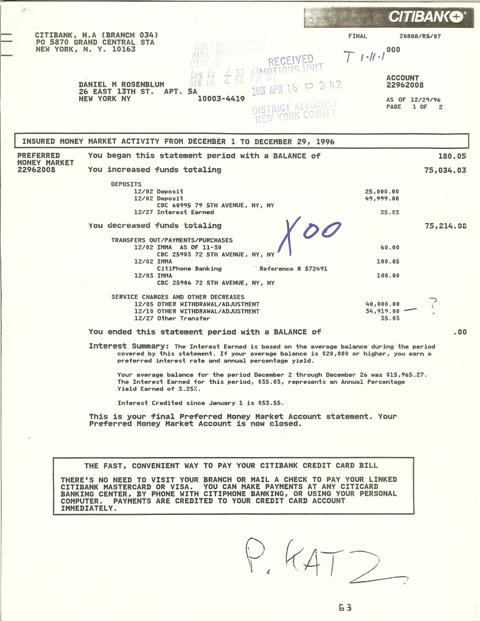

The Monday after Thanksgiving I deposited 4 (four) checks from accounts associated with creditors (Chase, Citibank, and AT&T Universal) with whom I had longstanding applications for credit into one Citibank Insured Money Market Account (the dollar amounts are reflected below on my banking statements and in my August 1997 complaint to the Office of the Comptroller of the Currency, images are below). There was no money available, and no activity in the Citibank IMM account which could be construed as confusing when I deposited the 4 checks to the IMM account (see my Citibank account statements below for November and December 1996 which reflect no other activity other than the transaction here described. There was not an inkling of deceit or trickery. Also note that I have been banking with Citibank at the same branch on 48th and 3rd again beginning 2005 and continuing presently in 2012 with a personal bank account and several business accounts, including the 21st Century Digital account and TTS Industries account, which, suffice it to mention, have very small balances but are functioning Citibank accounts nonetheless). The only way the checks should have cleared would have been if the applications for credit associated with each of the four checks checks written were approved. If not approved, the checks should have bounced and I should have paid a bounced check fee. Each credit account from which the checks were drawn were in my name, bearing my signature. The IMM account was in my name only. A copy of my account statement is below.

I spoke to offices associated with each creditor (Chase, Citibank, and AT&T Universal) account on which each of the 4 (four) checks were drawn on several occasions, and told them exactly what I was going to do before I did it. The applications for credit associated with the four (4) accounts had been pending for several months. I had held discussions over those months with each creditor explaining my goals for TTS Industries, which I had established May 20 1996 (my TTS Industries 16th Anniversary May 1996-May 2012 webpage describes the acronym and history). My loan applications for each of the four (4) accounts were pending without decision since May 1996. By Thanksgiving I wanted an answer. If the loans were denied I would begin a concerted effort for capital with creditors other than Chase, Citibank, or AT&T. I wrote one (1) check from each of the four accounts and deposited them into the IMM account on the Monday after Thanksgiving. I was 27 years old, and had mainly dealt with Citibank, Chase, and AT&T as creditors, not others, since I was of age to obtain credit. As creditors, these companies over many years had issued me small amounts of credit as credit cards or credit lines which had helped to fund my education during which time I developed the ideas for TTS Industries and 21st Century Digital. As Thanksgiving 1996 approached and my primary creditors still issued no definitive response on my applications for what I considered seed capital for 21st Century Digital, I made it clear that if I needed to approach other creditors I would not re-apply with Citi, Chase, or AT&T during 1997 with those creditors. Some business people might criticize my approach as naive; the fact remains this was my approach. Further, during college I had much experience waiting tables at restaurants on Long Island. I was pretty certain that during the several remaining weeks in December I'd be able to earn some extra holiday cash if necessary; if Citi, Chase, and AT&T denied my loan applications for TTS Industries, I would close that chapter in my solicitation for capital and open a new one before the Christmas holiday and New Year's 1997.

When I deposited the 4 checks on the Monday after Thanksgiving, and explained to my creditors that I would seek capital for TTS Industries elsewhere if the checks bounced, it was to get a final response from those creditors. Surely the checks should have bounced unless the creditors decided to approve loan applications associated with the accounts on which the checks were written. The only task before the bank was to accurately process the numbers on the checks as those numbers related to the dollar amount available or not in the accounts. There were four checks deposited on a Monday in an account which by definition took 4 days including the date of deposit to process. Two of the four accounts on which the checks were drawn were Citibank accounts, no less.

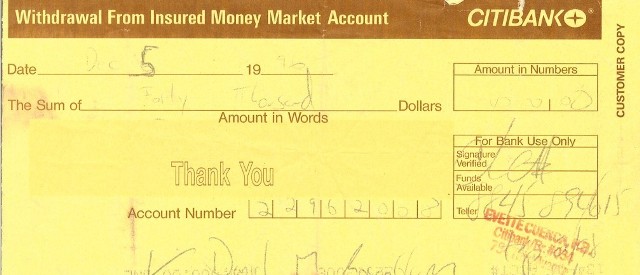

I waited three days. On the fourth day, the Thursday one week after Thanksgiving, I presented a withdrawal slip at the Teller's Window at the Citibank branch on 3rd Avenue and 48th Street in Manhattan for $ 40,000.00. I figured the checks would bounce if my creditors did not honor them. $ 40,000.00 was a percentage of the checks which debt I had determined I was willing to incur without additional capital. The Internet era was in its infancy: Alan Greenspan's utterance "irrational exhuberance" in connection with the dot-com bubble was unknown to the world. There was no Google, no Facebook, no IPad or IPhone. I had established the company TTS Industries, which acronym is described on my website, and was planning to applying for a business method patent. I did not want to go the IPO route of the "dot-coms"; I wanted to wait and calendar any IPO for President's week of 1998, 15 months away. I wanted seed capital to come from a bank/creditor with whom I could work past 1998, didn’t want to sell off shares of interest in 21st Century Digital to venture capitalists who might steer the venture and trademark name in a direction other than I had developed for the long term. A quick profit could certainly have been made in cell phones or something similar with the trademark, but the long term goal associated with a 21st Century Digital Network could be compromised, even ruined, and wouldn’t be worth it. Even if I didn’t make a dime for a year or 18 months, I had made the determination that I was willing to incur $ 40,000.00 in debt from Citibank, Chase Manhattan, and AT&T Universal, from which creditors the 4 checks were drawn. In fact, these were my preferred creditors given the my survey of the landscape. However, if they were unwilling to provide backing, then I would have to go elsewhere and make a determined effort. By October and November 1996 I wanted either a loan rejection or a loan approval or I'd move my applications for credit to other entities. I made it clear this was the case. In presenting the checks, to an account which took four days to clear, I took the matter into my own hands. If the checks drawn from potential credit accounts went unpaid, I'd have my rejection answer and I was willing to pay a bounced check fee, after which I'd write an application elsewhere. I was of the mind that there should be no way whatsoever that money would be released to me by a bank in the business of processing money accurately if the creditors hadn't decided to provide credit. Especially in the dollar amount of $40,000.00 from accounts which otherwise had $0 .00 balance.

I went to the Citibank branch at 48th and 3rd in Manhattan early in the morning on Thursday December 5th (exactly one week following Thanksgiving 1996) , and checked the ATM with my ATM card. The ATM indicated that I would need to speak with a branch officer, no information was available on the account through the ATM. Branch officers told me I'd have to call the Citibank National telephone line, which I did. No information on the account was available. I waited in the branch for about an hour, no information was available. I went to a Chase branch to ask about my Chase Ready Credit application and the check I had written on it before lunch, they had no info. I returned home to my apartment on 13th Street and University Place near NYU and Union Square, and spent an hour or two on the telephone with Citibank, Chase, and AT&T, all the while articulating the same as indicated above. I wanted an answer on my pending loan applications. There were two more full work weeks prior to Christmas 1996. If Citi, Chase, and AT&T were not going to provide capital given the information I had put forth regarding TTS Industries since May, then I was going to make concerted efforts to gain access to credit/capital elsewhere beginning in the two weeks before Christmas and continuing in 1997. After noon on Thursday December 5th I went from my apartment on 13th Street in Manhattan first to the Chase branch on Madison Park (about Madison and 21st Street I think) to enquire about my Chase application and the check I had written. The Chase officer I sat with told me that Chase was going to honor the check had deposited at Citibank, effectively indicating that my Chase line of credit had been opened. I proceeded to Citibank again on 48th and 3rd. There was still no information on the ATM, and the clerk at the information kiosk had no information. As per above, I was operating under the principal that my deadline had arrived. I didn't want to devote another day, another week to credit officers asking additional questions or asking me to wait additional days. But I did not yet have a definitive answer, I still had no answer. To get a final answer, I wrote a withdrawal slip on the account to which I had deposited the checks in the final hour before the branch closed. I got on line to the Teller's window. I presented the withdrawal slip to the teller. I was asked to sit and wait, which I gladly did. I waited the better part of an hour. It seemed to me that the branch manager and other branch officers were deliberating. I had had multiple conversations during the day with Citibank national line as per above. I was asked to sign papers, which I did. Then I was escorted back to the Teller's Window. The Teller gave me a slip of paper, and told me I'd have to go down to the basement of the branch to count my withdrawal, and told me there was about $35,000 left in the account. I said 'wow'; it seemed to me that upon deliberation Citibank, Chase, and AT&T Universal had decided to approve my applications for credit. I would not have to approach the other creditors in the final weeks before Christmas 1996. I went downstairs, counted the $40,000.00, and left the branch. The next morning I was called by Citibank, and asked to return to the branch to discuss the account. I did, and was told the FBI and DA had been contacted, and I was arrested on an allegation of felony grand larceny.

Here are copies of my bank statements for the time period described above and a copy of the withdrawal slip I utilized on December 5th 1996:

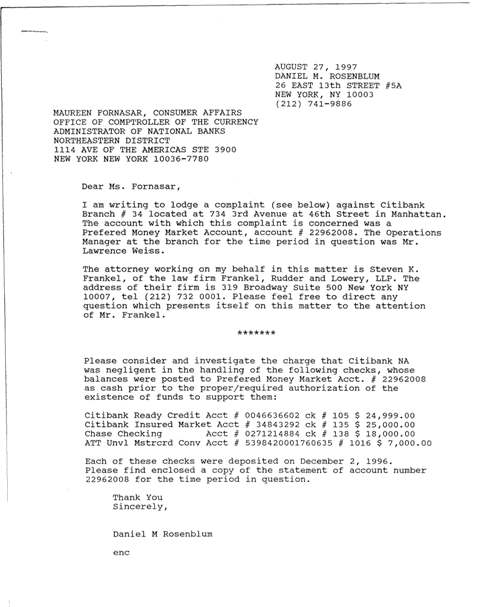

I wrote this letter to the Office of the Comptroller of the Currency in August 1997, it shows the dollar amounts of each check deposited and my enquiry to the OCC. In the letter I am still referring to Frankel as my attorney, but that would soon change as described below. There is much more to this facet which I will elaborate upon in due course:

Thursday December 5th 1996 was the Thursday one week after Thanksgiving 1996. I presented the withdawal slip 12/5/1996, at the Teller's window. The Citibank account statement below shows my $40,000.00 withdrawal on 12/5/1996, and then also shows a withdrawal/adjustment on the 10th of December for $34,919.00. That December 10th withdrawal was done by the bank, there is no question about that item on the account statement as far as the allegation by Citibank against me. I sat in the bank for an hour and received Management Approval for the Withdrawal, three days after the checks were deposited.

Importantly, under consideration here is the accurate processing of data. The business initiative which TTS Industries and 21st Century Digital represents at its core pertains to accurate, productive, efficient data processing. In 1996, the evolution of the digital industry as the 'internet' as we know it was in a transition. Note that accurate productive efficient data is not necessarily a 'banking' product product or service. Note that the only data which Citibank had to process accurately was the relationship between numbers on four checks and money in an account, and that I had pending loan applications on each account from which each check was drawn. Note that my withdrawal was made with "management approval", and that I had every reason to believe that upon deliberation my credit applications were approved resulting in funding of my accounts. Note that by definiation a "bounced check" fee charges a fee for a check written on an account which has insufficient funds. Note that on one or two occasions in the years prior I had indeed had checks which went unpaid due to insufficient funds and had paid a bounced check fee. Note that on multiple occasions including at least 5 on December 5th 1996 I specifically told Citibank officials what I was doing, that if the credit lines were not approved I would solicit "seed" capital elsewhere and cease to seek such capital from Citi for TTS Industries for an extended time. Note that after seemingly endless deliberations on Citibank's part that very day, Citibank paid the money through the teller's window. To be certain, some might criticize my approach as unconventional and non-traditional. But I did nothing to confuse Citibank's system. There should be no way I could make $40,000.00 come through the tellers window at Citibank on a Thursday by depositing checks in the account on Monday. There is, really, no way I could make $40,000.00 come through the teller's window if there is no money in an account, and I should be able to rely on that fact.

On Friday 8 days after Thanksgiving 1996, the day after I made the withdrawal, Citibank accused me of Felony Grand Larceny through the FBI and Manhattan District Attorney's Office. On that day I was put in prison in Manhattan, and arraigned in Manhattan Criminal Court.

As per above, I was arrested Friday December 6th 1996, eight days following Thanksgiving 1996 following a withdrawal of $40,000.00 at the Citibank Teller's window on Thursday December 5th based on 4 checks drawn from credit accounts in my name deposited on Monday December 2nd 1996. On the afternoon of Friday December 6th 1996 I was processed at the NYPD 17th Precinct, then imprisoned Friday evening awaiting arraignment which occurred Saturday December 7th in the wee hours of the morning.

I was supposed to meet my parents Friday evening in the offices of a longtime friend at the headquarters of Ernst and Young, then have dinner. I called them at the friend's office at Ernst and Young where he was a partner- we had set up the meeting to discuss TTS Industries a little. I debated whether to ask my parents to hire an attorney or not. Since I was supposed to meet my parents that night, they would have been very concerned that I did not show up, and very concerned when they could not find me. I called from the 17th precinct on 3rd Avenue at 50th Street on Friday afternoon. I was arraigned Saturday night. My parents hired an attorney, and they posted bail for me, which was set at $5000.00 (five thousand dollars).

The attorney who represented me at arraignment December 7th did not stay on the case. During the next few weeks in December, I set out, with the assistance of my parents and brother, to hire another attorney to represent me at the next court date, and to have contact with the District Attorney's office.

I felt very strongly about all the parameters outlined above, and wanted my defense in the case to revolve around those parameters. In addition, I was very concerned in 1995 and 1996 about the relationship of the business model I had in mind for TTS Industries to the financial data processing services which banks were offering. Recall that in 1995 and 1996 the internet was still in its infancy. There was no such thing as Google or Facebook or any semblance of those two companies. In fact, no one was sure how the internet backbone would become monetized. No one was sure how any fees for services would be associated with any aspect of internet commerce. There was not yet any model of click and pay, etc.

Over the years I have done some writing in law school, business school, and in my trademark and patent applications on laws and regulations pertaining to banking and data processing. Specifically, on Section 106 of the Bank Holding Company Act of 1970 , Permissible Activities for Bank Holding Companies, and the Durbin Amendment to the Dodd Frank Act, each of which is posted on my website. The theory contained in that writing merits additional analysis insofar as a consideration of productivity and efficiency in the data processing industry. In capital theory, bank income hould derive solely from traditional banking activities: loans, discounts, deposits, and trusts. Today, in 2012, still less than two decades into the internet era and the advent of any semblance to a digital industry, banking entities remain dedicated to their core commercial enterprise of loans, discounts, deposits, and trusts; however, the self same banking entities are privileged to earn over $ 16 billion per year in interchange fees for processing "credit card data". There are several issues in play which merit in depth economic and regulatory analysis if the goal is a productive, efficient economy. This webpage presently is not the place, as the purpose of this webpage is a brief discussion of my 1996-1999 Manhattan Criminal Court docket originating with an allegation of Felony Grand Larceny made by Citibank after four checks posted as cash to my Insured Money Market account, so I will return to that subject, noting that my applications for admission to Brooklyn Law School in 1998 and New York Law School in 2006 contemplate the relationship of BHC fees for financial data processing to the non-financial data processing industry, and such subject matter is indeed of great interest to me. The whole '21st Century Digital' business model revolves around data processing using internet technologies, my writing on the subject is available on my website and in my patent application and otherwise. I was of the mind in 1996 and 1997 that there might be certain related antitrust issues to contemplate in 1996, and I was also of mind that certain facets of the BHC Permissible Activities Doctrine merited additional analysis in 1996. Therefore, I registered at least one complaint on that subject with regulatory agencies in third quarter 1996. At the time I was setting up the business entity TTS Industries to tackle such issues, and to offer a product as a solution to such issues. On this I will elaborate elsewhere, as here now I would like to introduce the major subject matter of the unanticipated debacle which ensued during the first quarter of 1997.

I was of a very clear mind that any defense against the Citibank allegation of felony grand larceny should attack the merit and validity of the allegation by Citibank itself, and should consider as well negligence on the part of Citibank in processing the data associated with the four checks if in fact no credit had been approved. Citibank had made a statement to NYPD which I considered to be false, perjurious: the statement at root of the allegation of felony grand larceny was that I did not have permission to possess the monies given to me through the teller's window. For argument's sake here, to be in possession of property without permission is to have committed a larceny. Citibank gave me management approval to possess the monies. I was of the opinion that if Citibank wanted to revoke permission they would in some way shape or form need to admit error, or some other action. Over the many years I have tried to find similar cases but have not. In casual dialogue about aspects of the matter, I have heard attorneys in banking state that Citibank had the authority to demand return of the monies immediately on Friday December 6th 1996 when I returned to the branch. I never made the case that the monies were irrevocably mine to keep forever. Rather, I was of the mind that I had incurred a liability following an approval of credit, which money was due back to the lenders of credit according to the terms of each line of credit. The $40,000.00 was in excess of any one credit accout of the four from which funds could have originated (see my August 1997 letter to the Office of the Comptroller of the Currency above for the dollar amounts and four account types). In order for $40,000.00 to be available, at least two approvals would have been necessary. I did not want to incur a liability less than $40,000.00, nor to one credit account only. If less than $40,000.00 had been available, my withdrawal slip would have been denied and I would have left the bank.

If there had been no credit approval, it seemed to me that Citibank would be due back monies immediately if they indicated there had been an error in releasing monies through the window. Or, if there had been no error at the teller's window but rather the lenders had mistakenly approved but wanted to revoke the line of credit, it seemed Citibank should have to do so in writing to document the exchange. I was of mind that at a minimum Citibank should have had to produce a writing before the money which was in my possession had to be returned to Citibank if it had to be returned- I had in my possession the monies, and the management approved withdrawal slip, and the applications for credit associated with each account on which the checks were drawn. On December 6th, 1996, following statements by Citibank, the NYPD asked me if they could look around my apartment. I said sure. We went to my apartment on Friday December 6th, the date of my arrest. They handcuffed me once we were inside, looked through my apartment, came across the money I had withdrawn- which was not hidden, and confiscated it. Based on the Citibank allegation, NYPD also took my computer, and an array of assorted files all of which was confiscated as evidence based on the Citibank statements. Again, I will not detail and document all facets of this parameter here, but I do have all such documentation. My concern here is that when I was interviewing attorneys, I was adament that my defense against the alleged larceny (non-permission to possess funds) be based solely on the merit of the allegation that I did not have permission I had to possess such funds.

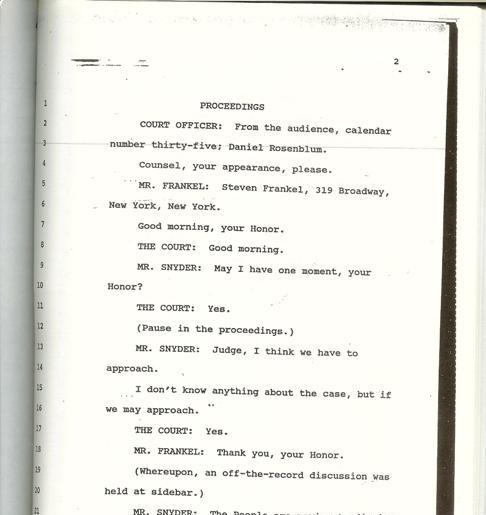

THE UNAUTHORIZED DEFENSE DEVISED BY AND ENACTED BY STEVEN K. FRANKEL OF FRANKEL RUDDER AND LOWERY DURING JANUARY AND FEBRUARY 1997

During the second and third weeks in January 1997 my search for an attorney continued, but I was strongly encouraged by my parents and brother to hire Steven K. Frankel. I met with Steve several times during late December and early to mid-January to discuss the case and to discuss whether he would be hired or not. I did not, however, hire him to represent me. In fact, we did not arrive at a definitive contract, we only discussed varied proposals as to how we might proceed and how payment arrangements might be had. I was clear that he had not been retained, and I was clear that he would not be retained unless a satisfactory contract was arrived at, and unless we arrived a clear plan insofar as how my defense in the matter would be put forward.

There are many small details about what occurred in January through March 1997, which I am happy to put forward and document, and which substantiate what I am here putting forward. Here, now, however, I will only cut to the heart of the matter of what occurred against my expressed desire, and what I note was an unauthorized legal defense concocted by Steven K Frankel.

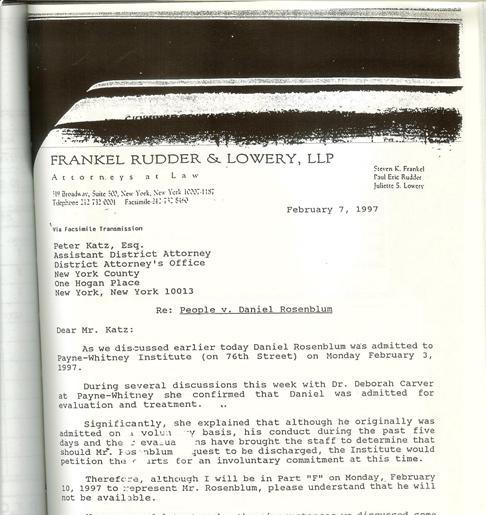

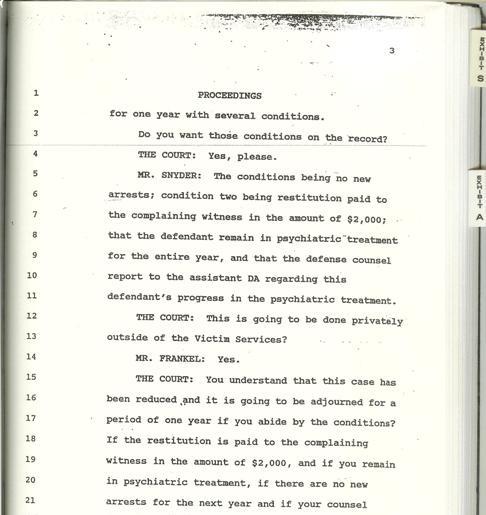

To be certain, I was upset with the Felony Grand Larceny Allegation lodged by Citibank, and I was upset that my computer had been confiscated, and that my plans for TTS Industries had been put on a major hold, and that I was in a position whereby I had to defend my actions as if I had committed some heinous wrongdoing. I told my parents and any attorney I interviewed that I felt that way. Eventually, Steven K Frankel and my parents suggested to me that indeed I had been wronged, and that perhaps we should document the stress that the event was causing me. At the same time, Frankel and my parents suggested that one line of defense in Criminal Court could be to bring into question my 'intent' during the transaction- Frankel explained to me, a non-attorney, that in order to be guilty of crime the perpertrator needs to have intended the crime. While I agreed I had not intended at any time to steal any money, I was adament that Frankel or any other attorney not stray from attacking the validity of the allegation by the bank. If he was to represent me, I wanted him to concentrate on banking law and the transaction which had occurred. Frankel told me he agreed, and told me he had spoken to the Judge in the case and that the judge thought what Citibank had done was an atrocity. Frankel took me out to dinner, and he paid me monies during January 1997. But he also continually indicated that he was a criminal defense attorney only, and that it would be inappropriate to bring banking law into criminal court, that I would have to get the charges dismissed in criminal court based on criminal law alone. I insisted that we find someone with banking law expertise to consult with, to analyze all facets of the transaction. Frankel disagreed, and every time the subject was brought up, he steered me away from it. This was an issue which contributed to not arriving at a retaining contract. However, my parents and brother and Frankel himself continued to pressure me to move forward on certain aspects of the case, including the fact that the case had caused me some stress.

With that in mind, Frankel and my parents coaxed me to enter Payne Whitney, a psychiatric institution, for an evaluation of the stress which Citibank had caused me following the felony grand larceny allegation. Unbeknownst to me, however, Frankel and my parents and a psychiatrist they were working with fabricated a full patient admission profile which became associated with my entry into the hospital as my "patient history". It was more than a year until I saw my admission papers and 'patient history' which is a few pages of a narrative which tells the untrue story of some 15 years of mental illness. That is, I was admitted into the hospital with a false, fabricated patient history which told the story of 15 years of delusional, psychotic, distressed behavior- all of which is patently false.

In my life to that point it had never been suggested even remotely by any individual on the planet that I had any semblance of any mental illness by any doctor, collegue, professor, friend, relative, or otherwise. Similarly, since then, apart from the core group of doctors associated with the debacle here discussed, no individual connected with me whether socially, academically, in criminal justice, in law enforcement, in an employment scenario, or otherwise has remotely suggested that. Yet my patient history and admission papers- which I had no access to nor was aware of until I made a request for them a year later- tells a narrative, as if it were true, of a downward spiral into mental illness beginning during my adolesence, getting worse during junior high school and high school, and so on through college and culminating with grand delusions etc in the years recent to my arrest on felony grand larceny. When I entered the hospital, I did so anticipating a consideration of stress caused by an undue allegation of felony grand larceny.My attorney and the psychiatrist he was working with and my parents coaxed me to voluntarily enter into the hospital which was described to me as a very comfortable hospital, where I'd go for three days of consultation and discussion. They said it wasn't The Plaza, but it was very nice and professional and while not luxurious, very comfortable and professional. I anticipated interesting discussion about psychiatric theory, etc. The hospital was on the Upper East Side of Manhattan, on 68th Street at 2nd Avenue. However, upon admission, I took an elevator to a floor full of some 70 to 100 mental patients in hospital gowns. I was led to a room with some four cots or hospital beds and one shower to share. There was a common room with a television where the patients were watching on old TV on the wall. I was locked on a psychiatric floor at at Payne Whitney Hospital, and soon 'for my own good' forced to take a all kinds of medications and allowed to step off the locked floor full of mental patients only a half hour a day. When I complained about not having my own room, and of being grossed out, confused, and even disgusted by the environment, I was told that I had issues of entitlement and narcissism. When I refused to take the medications, and requested in writing to leave the hospital, my priviledges to leave the floor were revoked, until I "came to terms" with my "illness". The "illness" was described to me in various ways. In due course, at times I was coaxed to believe that in fact the "illness" was brought on by the felony allegations and that the staff was helping me through the difficult time. But at other times it seemed the staff was of the impression that I was not understanding some illness which had plagued me for many years. The whole experience was extraordinarily confusing and discomforting, and I was not permitted to leave the hospital for many weeks. I have much documentation about the whole ordeal, which, in due course I can elaborate on.

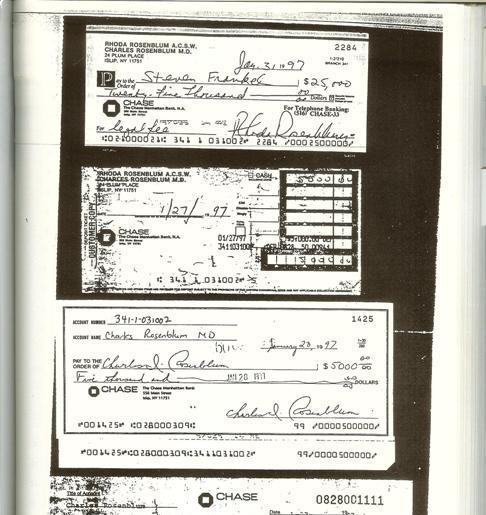

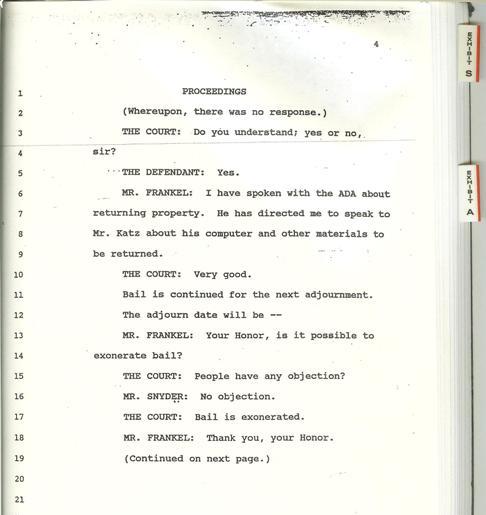

It was only a year later that I found out that my parents then paid an exhorbitant sum of money, some $30,000.00 to Steven K. Frankel as I was being admitted to the hospital (see the copies of checks written to Frankel January 31st 1997). While I was in the hospital and heavily medicated it was explained to me that Frankel had been retained to represent me. If I protested anything while in the hospital, I was only forced to take more medications, which then only confused me more and made me unable to participate in my own defense. As the records below show, Steve Frankel gave a letter to the District Attorney's office indicating that I was a psychiatric hospital and would not be able to make it to court for my February court date. From inside the hospital as that occured, I could not argue with what Frankel was doing- if I did, it was received as defiance- a symptom of the "illness" I had since adolescence. I did, however, attempt to instruct Frankel on what to do in court, what to say to the judge, etc. I have documentation of everything, which in due course I intend to here document to the extent that it makes my point and verifies what I am here stating.

The court transcripts below suffice for the time time being in painting a portrait of what occurred in early 1997. I wanted to stand by my actions, and defend them. But I was robbed of the opportunity to defend my actions. To be certain, I was imprisoned in the hospital during January and February of 1996, and incapacitated by medication forced upon me, without any due process. The staff at the hospital at first let me step outside the floor I was on for 30 minutes a day, supervised. When I became agitated and wanted to leave the hospital altogether, or refused to take medications, my 30 minutes was revoked. I have all the supporting paperwork which documents this. Until I 'came to terms with my illness' I was forced to take more medications and not permitted to leave the hospital. One day of such treatment feels like imprisonment. I was treated like this for weeks. I had no idea that every doctor I spoke to during those first few days and the ensuing weeks were first reviewing my 'patient history' - a fabricated concoction written by Miller and Frankel with my parents which tells an untrue story of a history of a downward spiral of mental illness which had endured such adolesence - a period of some 15 years of trouble in my home community and in High School and college and suicidal tendencies and grandeur and disillusionment. The patient history worked around some facts which had occurred in my life, but little else in it was true. Doctors at the hospital proceeded to interview me with the admission history in hand, asking me about the factual history but receiving my verbal remarks in disbelief and criticizing me on tiny little points which then confused me and caused me to become noncommunicative. I had entered the hopsital under the impression that we were addressing stress brought on by the allegation of grand larceny, when in fact each doctor was approaching me as if the issue was to educate me to come to terms with a longtime illness. I certainly did become agitated, a bit paranoid while at the hospital in response to the eery way in which I was being received and the way in which medication and treatment was being forced on me in a way which had no semblence to the consolation which I anticipated given the way I was coaxed into the hospital.

Of utmost import as it pertains to the legal case of the allegation of Felony Grand Larceny is that I could not defend against the Felony Grand Larceny as I wanted to. Below are copies of checks paid to Frankel, and transcripts of proceedings while I was in the hospital, and then again shortly thereafter. My request for hospital records was written in June of 1998, I received and reviewed records during summer of 1998. During summer of 1998 some of the ordeal I had experienced in 1997 started to make more sense as I discovered that I had been admitted to the hospital with a fabricated patient history. I had suspected something had been awry, given how I was treated, but could have never guessed the extent. Further, during that time period if I displayed any emotion resembling suspicion it was labeled as paranoia by those doctors or my attorney or my parents. It was a very trying experience. Soon thereafter I sought to have the attorney investigated, and challenged my parents on what had occurred. Earlier in 1998 I was accepted into Brooklyn Law School, and was to start in August 1998. I matriculated, but I was still on charges of Grand Larceny- they were not actually dismissed in entirety until April 1999 by Judge Ellen Coin. I could not get a loan to finance Brooklyn Law, and therefore was 'involuntarily withdrawn for failure to meet my tuition obligation" on or about Labory Day Weekend 1998 as I continued to seek regulatory analysis of the Citibank transaction and Larceny Charges. I tried vigorously to have regulatory analysis, but encountered again what seemed an absurd co edy of erros: through April of 1999, it seems the regulatory agencies were relying on Manhattan Criminial Court, which in turn was relying on Payne Whitney and the Social Security Administration. I cut off my association with my parents, as I was disgusted with what had transpired on 1997 on its face, and with all summer 1998 dialogue on the matter following my receipt of the hospital records. As my lease was expiring in October 1998, I had previous hopes that law school financing would afford me room and board. My ability to earn through work was very very complicated given the status quo of the larceny charges, the hospital stay, and the law school predicatment. As my lease expired I vacated my apartment at 26 East 13th Street in Manhattan.

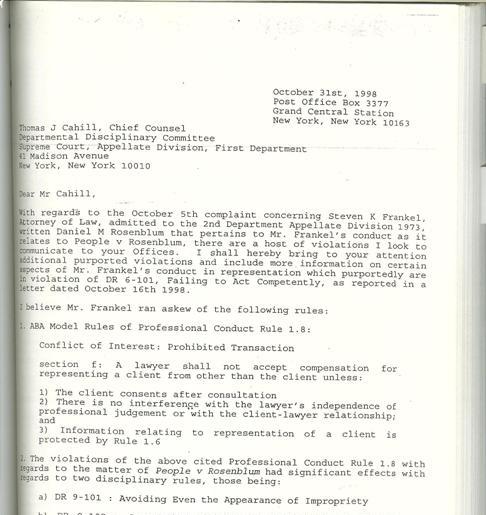

Over the years I have made concerted efforts to rectify the above situation to no avail. Most of my efforts to rectify the situation were made in the immediate aftermath of the debacle described above. I have much more documentation, which I intend to publish here on my website to paint a full accurate picture of what occurred pertaining to this debacle during the late 1990s and early 2000s, during most of which time I lived without domicile. As far as Steven K. Frankel is concerned, I have hopes that over time the Departmental Disciplinary Committee, 1st Department, will take another look at the complaints I filed regarding him during the late 1990s pertaining to this case. Based upon my interaction with him, I would prefer to see Steve Frankel sanctioned at a minimum by the New York State Bar Association. Similarly, I would like to see the psychiatrist Frankel worked with, Frank Miller, sanctioned by whatever the licensing organization for psychiatrists is. Around the year 2000 the Departmental Disciplinary Committee indicated to me that my query had been addressed. There was little more I could do at the time to push the matter forward.

**

After I found out about the fabricated patient history, it was very difficult to maintain an association with my parents, and Frankel. I wanted to correct the record, but that process proved to be very difficult. It was mid 1998 before I received my request for records from the hospital. I had made application to Brooklyn Law School during late 1997, and was set to start in August 1998. During several months in 1998 I approached my parents about the debacle I had uncovered, and challenged them on the stories they had told me prior to my admission to the hospital, and about the months after I left the hospital. I was very unsatisfied by their responses. I applied for loans to finance Brooklyn Law School, but was unable to achieve a loan for law school.

Fortunes were being made in 1997 and 1998 for savvy business people whose attention was directed at the nascent internet. The regulatory environment was being shaped. I was stuck on the sidelines, I stood accused of Felony Grand Larceny throughout 1997, 1998 and 1999 until April 1999 when the charges were dismissed in court. I had been labeled as having a mental illness which had caused the Larceny, which was therefore excusable. on allebeing led to by my parents and my attorney, and being treated by psychiatrists who held a fabricated patient history i had never seen and which was wholly untrue. Any discussion i had about my ideas associated with my business was a discussion in my defense, not with business but while on charges of larceny. The scene was a mess, and very difficult 16 15 and 15 years ago.

Further complicating matters, During the time i had not seen the fabricated patient history, any suspicion of foul play i articulated wa simply labeled "paranoia", a sympton of my "illness". Further, any act of defiance by me was also received that way. Hence, i kind of had to accept the status of matters, or, fear being treated as even more "ill"; for example, at court proceedings i could not object to the terms and of the ACD; doctors told ke i could not work, etc...

add SSA. Extensive filings and dealing with SSA. I have always maintained to SSA that I could not have qualified for SSA Disability monies, except for the fact that I made an application for SSA Disability while I was in Payne Whitney hospital as described above during the time period that all privileges, such as leaving the hospital for even 30 minutes, were denied me unless I "came to terms with my illness" and took medications forced on me. The file at SSA which found me to qualify for SSA Disability beginning in 1997 when I was admitted to Payne Whitney and then kept there contains exactly the same fabricated, false language of my admission to Payne Whitney, which only Frankel and Miller could have written: it indicates with exactly the same laguage that I sufffered from debilitating mental illness beginning at adolescense, that I was isolated without friends as a teenager, that I had great difficulty with academices in high school and college, that i was ever delusional with gradiose ideations, etc. Again, my SSA file is extensive, in every instance that I indicated that I had no disability, the SSA simply continued me on disability, using my protestations as evidence of disability. In time I will dedicate a webpage or too to documentation of this facet, my dealing with the SSA 1997 to 2005. , Coin transcript

Of primary consideration my letter to the Social Security Administration dated April 5, 1999, received April 5th 1999 by Ms. Saverino of the Social Security Administration at 26 Federal Plaza Room 31-120 on April 5th 1999.

From 4/5/1999 to SSA:

“(a3) I welcome with open arms your review. Of greatest concern is the integrity of the evaluation at Payne Whitney Hospital which produced the diagnosis upon which the Offices of Social Security based their decision that I fact I was eligible for benefits. It is my understanding that you have in your possession Hospital generated documentation indicative of said evaluation. It is my contention that the evaluation with which I was admitted to the Hospital was fabricated. Please refer to the Departmental Disciplinary Committee letter of today’s date at this juncture as the intent is intricate to what follows.

My letter to the Social Security Administration dated April 5, 1999, received April 5th 1999 by Ms. Saverino of the Social Security Administration at 26 Federal Plaza Room 31-120 on April 5th 1999. The letter contained 10 addenda, including 9 pages of materials I filed that week with the Departmental Disciplinary Committee in addition to materials I had filed with the NY District Attorney’s office. The cover page of my 4/5/99 SSA letter states my Social Security benefits claim, lists the 10 packets of addenda, which includes additional support to my allegation of fraud by attorney Frankel and psychiatrist Miller, including hospital records.

While I often speak of my love for camping, and the time I spent camping on the beach in East Hampton, Southampton, and Port Authority of NY and NJ Pier 34- I do not often speak of how I ended up without domicile. Below is one synopsis, which is a work in progress; I have much more documentation and there is much more to the narrative, but, at least this is a detailed sketch. I rarely talk about most of the details here referred to; rather, more often than not, I simply discuss how much I enjoyed camping on the beach because I prefer to speak of pleasant times than difficult issues when it comes to discussing 1997 to 2005)

http://www.twentyfirstcenturydigital.com/TTSWiborg.php

I feel very strongly that, in the transaction which culminated with Citibank effectuating a Felony Grand Larceny allegation through NYPD, there was no semblance of deceit or trickery on my part. If the transaction is viewed in the light of any other service industry, Citibank failed tremendously. If a carpenter is hired to build a deck, it should hold weight. Here, 75 thousand dollars posted as cash to an account which cash was apparently absent. An important element here is the extent to which simple data was accurately processed over a four day period- and the extent of appropriate remedies associated with any mistake or error which might arise during the task/ service performed. In the digital era, such questions are paramount to effective and efficient productivity in the general economy.

**

Please note, this web page is a work in progress.While there are images of legal filings on this web page, the web page is not yet a legal filing. Current resources do not permit proper editing of this page, the author anticipates editing this and related pages perhaps over years to come as time and resources permit. Therefore, this page may, in its current format, contain errors or ommissions. It is the author's intention to, over time, correct any errors or ommisions. The subject matter addressed will, in time, be elaborated on, clarified, and further documented. The chronology of events will be further documented, and the relationship of the events here referred to to other related events will be clarified. In addition, please note that there is much more to this story, which has years of related events. The author has supporting documentation for all claims made, and will certainly be working on this material. However, if the author waited until everything was 100% edited and corroborated it would be some time before any related material was published.