_____________________________________

....AS AN INFORMATIONAL SUPPLEMENT TO MY ANSWER IN THE ABOVE CAPTIONED MATTERS, SUBMITTED BY DEFENDANT DANIEL M ROSENBLUM ("I", "ROSENBLUM" and "DMR" below.)

1 This current document is the main document of September 15,2013, and is Titled:

TITLE:"DMRAMEX091513"

Answer2/Main/Document/Information

TITLE:"DMRAMEX091513" Answer 2/ Main Document/Information

{Efiled Document #8; September 15 2013 #2 of 21 by DMR}

.....and is filed Suffolk County September 15, 2013. Efiled Document # 8, #2 of 21 items filed September 15 2013 by DMR.

This 47 legal page document titled DMRAMEX091513 is written in 40 individual paragraph/series which follow below. Eighteen of the §§¶¶ below are supported or additional details in a series of 18 Appendices which supplement the 47 legal size pages of DMRAMEX091513. Please see Appendices 1-18 EFILED 9/15/13.

The full list of Appendices' 1-18 Subject Matter by Document # and Paragraph # is the Suffolk County Index # 061458/2013 filed Document List, viewable on NY State Supreme Court website page for Suffolk County Index #061458/2013. An image of the same document list, which functions as a Table of Contents for the Rosenblum 9/15 2013 filing in Amex v Rosenblum can also be viewed on the page on Dan's website by clicking here.

ALL BLUE TEXT BELOW ARE ACTIVE LINKS TO WEBPAGES WITH ADDITIONAL NECESSARY AND PERTINENT INFORMATION REGARDING SUCH TEXT IN BLUE HYPERLINK FORMAT. PUBLIC NOTICE TO THE INFORMATION CONVEYED ON THE LINKED PAGES IS HEREBY CONVEYED BY THIS NOTICE OF INFORMATION IN SUPPLEMENT TO ROSENBLUM'S ANSWER IN THE MATTER OF AMERICAN EXPRESS vs DAN ROSENBLUM. BECAUSE THE WEBPAGES CAN/WILL BE EDITED AND FURTHER DEVELOPED, IN NEW YORK STATE SUPREME COURT THE INFORMATION CONVEYED ON SUCH LINKS IS E-FILED SEPTEMBER 8, 2013 IN PDF FORMAT AS "APPENDICES" TO MY INFORMATIONAL SUPPLEMENT TO MY ANSWER, AND ARE THEREBY FILED WITH THE COURT AND PLAINTIFF AS APPENDICES TO THE INSTANT CORRESPONDENCE, WITH THE INTENTION THAT SUCH APPENDICES ALSO STAND AS INDEPENDENT INFORMATION TO THE ABOVE CAPTIONED MATTER.

THIS NOTICE OF INFORMATION SUPPLEMENTS MY (Daniel M Rosenblum, also referred to below as "DMR", "my" "I" and "Rosenblum") ORIGINAL ANSWER FILED IN THE RELATED, ABOVE CAPTIONED NEW YORK COUNTY ACTION INDEX # 100156/2011 ON APRIL 14th 2011 AT 60 CENTRE STREET NY NY, WHICH ANSWER, TODAY, 9/15/2013 ALSO IS E-FILED IN SUFFOLK AS EFILE DOCUMENT # 7, "ANSWER 1", ABOVE, AND SERVED TO ZWICKER VIA EFILE, BUT, GIVEN THE NY CPLR SHOULD BE CONSTRUED AS 'FILED' AS OF SERVICE OF PROCESS OF THE SUFFOLK MATTER TO ROSENBLUM BY ZWICKER ON OR ABOUT JULY 4, 2013 GIVEN MY NEW YORK COUNTY FILING SOME 26 MONTHS PRIOR THERETO. (THE INSTANT INFORMATIONAL SUPPLEMENT TO 9/15/13 EFILED DOCUMENT #7, MY 4/14/11 ANSWER TO NY COUNTY INDEX 100156/2011, IS EFILED 9/15/2013 AS EFILE DOCUMENT #8, ALSO AS AN 'ANSWER' CAPTIONED ABOVE AS "ANSWER 2/INFORMATION" BECAUSE IT IS MY MAIN 9/15/2013 DOCUMENT FILING, WHICH ALL OTHER DOCUMENTS EFILED 9/15/2103 SUPPLEMENT AS APPENDICES AS CONVEYED IN THE INSTANT MAIN 9/15/2013 FILING IN 0161258/2013, AND ARE LISTED IN THE EFILE DOCUMENT LIST THEREFORE AS APPENDICES. THE ONLY OTHER DOCUMENT TYPE FILED 9/15/2013 IS A NOTICE OF DISCOVERY.

AS NOTED BELOW IN THIS INSTANT INFORMATIONAL SUPPLEMENT TO ROSENBLUM'S 4/14/2011 ANSWER TO ZWICKER'S SUMMONS AND COMPLAINT, AND IN THE APPENDICES TO SUCH SUPPLEMENT, THERE ARE MYRIAD PROBLEMS NOT ONLY WITH THE ZWICKER SUMMONS AND COMPLAINT, THE ZWICKER NOTICE OF DISCONTINUANCE, BUT ALSO PROBLEMS WITH THE ZWICKER PRACTICE OF LAW IN NEW YORK STATE AND OTHERWISE. THE SAME PERTAINS TO JAFFE'S NOTICE OF DISCONTINUANCE IN NY COUNTY, AND ASPECTS OF THE JAFFE FIRM'S CURRENT PRACTICE OF LAW.

2 NYSCEF EFILE NOTE TO THE INSTANT "INFORMATION" FILED SEPTEMBER 15 2013; all blue hyperlinks to Rosenblum's website appear to be are active in all paragraphs in the Efiled version of this document # 8 in the efile All such blue hyperlinks alert the reader to additional information regarding the paragraph of the hyperlink, and link the reader to such additional intricate, related, pertinent information. However, Defendant Rosenblum has also Efiled the information available at each blue link as an APPENDIX to this MAIN, Supplemental Information to my Answer Filed Efiled in Suffolk 2 weeks after Labor Day 2013. Henceforth this instant MAIN FILING OF SEPTEMBER 2 2013 will be referred to by Rosenblum in this filing as "DMRAMEX09152013". Appendices to "DMRAMEX09152013" will be labeled and referred to in sequence throughout the document by adding the letters APP to denote "Appendix" plus a sequential change in the final number of such moniker to denote which appendix is being referred to. Thus, the first appendix to DMRAMEX09152013 will carry the label DMRAMEX09152015APP1, the next appendix will carry the label DMRAMEX09152015APP2 and so forth. Each such appendix will also carry a short descriptive name along with the sequential label, which name is included in the "Document Description" field of the Efile Document List allowing for easy review. By the above convention, Appendices will always appear in proximity to active blue hyperlinks, to designate the Efiled Appendices which a reader on the Internet can click too but the Efile Reader can instead refer to the Efiled Appendix to such paragraph rather than following the link; all such information is as such conveyed to the Plaintiff, Plaintiff's attorneys, the Court, and the General Public. Please note that if hard copy is required by the court or any litigant, for one thing there will be delay given costs which Rosenblum presently cannot afford, and, over the short term if resources are able to be allocated by Rosenblum to printing the likelihood is black only ink. Note the use of the blue color font is solely to denote Active Hyperlinks in review of this filing but also generally easily alert the reader to all instances of pertinent Supplemental Info referred to in this writing; such information is hereby attached to this "Main Document" of my 9/152013 filing. In some instances below, an Appendix will be referred to in several different paragraphs or sections of the instant Main Document, DMRAMEX09152013; rather than file duplicate Appendices, Rosenblum will simply alert the reader to such duplicate appendices by the label attributed to the first instance of the use of such appendix. So, DMRAMEX09152013APP5 may be referred to in several instances but the document will only be Efiled in Suffolk once as the fifth Appendix filed on circa Labor Day 2013. Note that the reference to paragraph or sections numbers is as a convenience to the reader only- no paragraph is designed to be presently severable from any other in my filing as all are interelated. Lastly, please note again that, by design, all items today filed can be reviewed on the Internet by clicking the hyperlink rather than accesing the Efiled PDF; however, while the PDFs are static and will not change or be edited, the Internet pages will be continuously edited, refined, and developed. The Efiled version is current as of mid September 2013.

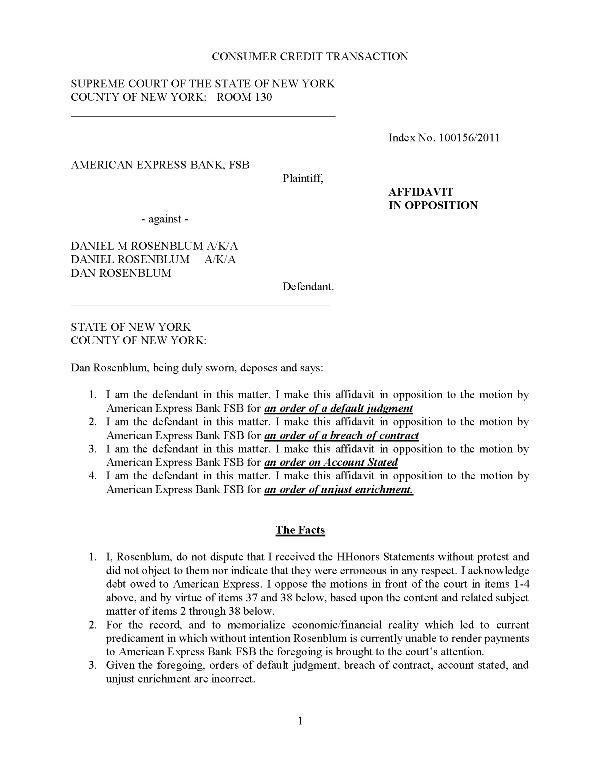

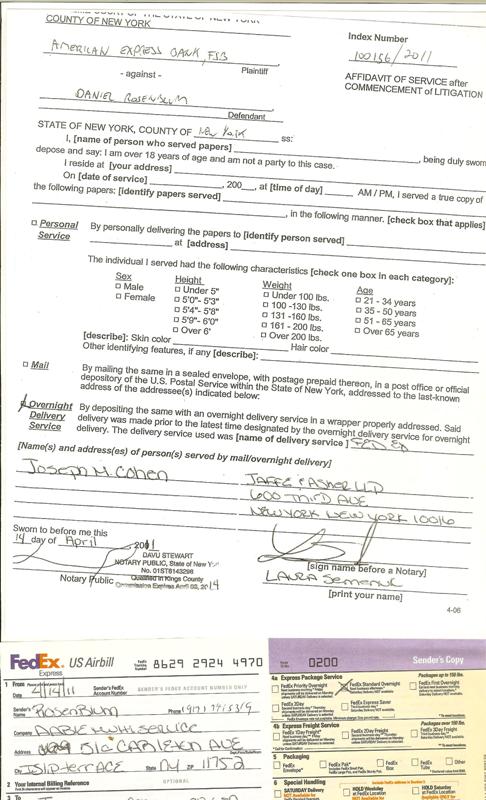

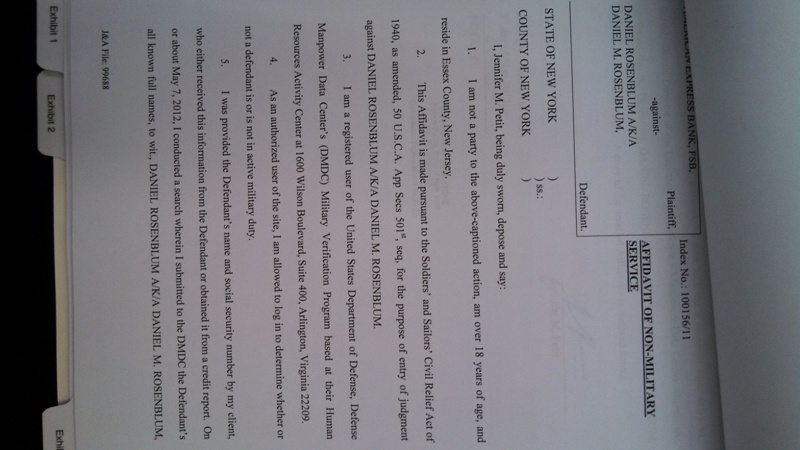

Note that Rosenblum's original Answer to the Amex suit was filed in New York County April 14, 2011, and can be viewed either in the NY County case file Index # 100156/2011 in the records room at 60 Centre Street, now also in the Suffolk County Efile, or, an image of my original April 14 2011 answer can be viewed below by scrolling this current document past the images of the CPLR and other relevant images and commentary until at Paragraph 29 below images of my 9 page 4/14/11 answer are displayed in Paragraph 29. Lastly, images of DMR's April 14 2011 Affidavit in Opposition can be viewed by clicking here or seeing the Suffolk Efile for Index 016458/2013 file, document : {DMR#1} TITLE: Answer 1; Affidavit in Opposition; originally filed April 14 2011 on Amex Card 371339213796009 Summons and Complaint NY County Supreme Index # 100156/2011 Attorney of record: Jaffe & Asher. Answer 1, Efiled Document #7.

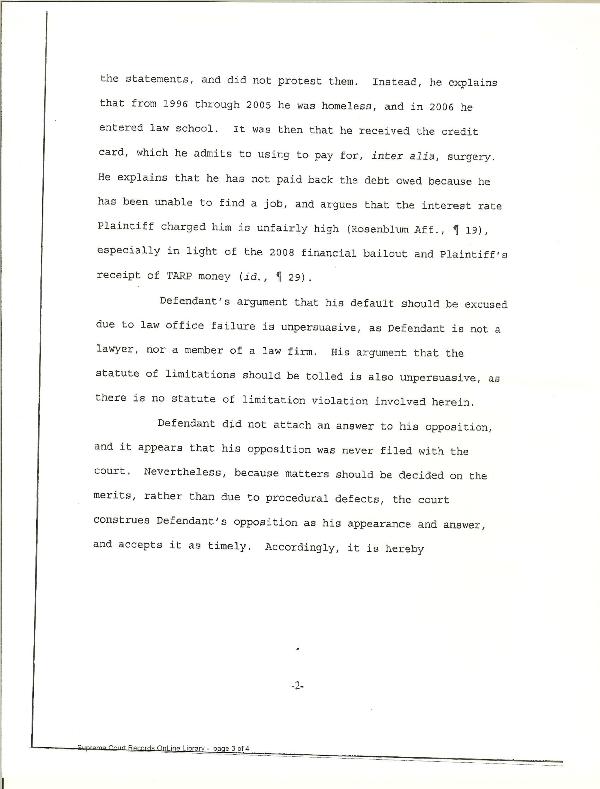

As a point of information here conveyed, I never disputed that I owed the debt to Amex, paragraphs 1 through 3 on page 1 of my 4/14/11 Affidavit in Opposition to the Amex suit state succinctly:

"1. I, Rosenblum, do not dispute that I received the HHonors Statements without protest and did not object to them nor indicate that they were erroneous in any respect. I acknowledge debt owed to American Express. I oppose the motions in front of the court in items 1-4 above, and by virtue of items 37 and 38 below, based upon the content and related subject matter of items 2 through 38 below.

2. For the record, and to memorialize economic/financial reality which led to current predicament in which without intention Rosenblum is currently unable to render payments to American Express Bank FSB the foregoing is brought to the court’s attention.

3. Given the foregoing, orders of default judgment, breach of contract, account stated, and unjust enrichment are incorrect."

On August 12th 2013 Rosenblum filed an August 11th version of this webpage in New York State Supreme NY County Index #100156/2011 by printing the first five pages to PDF and filing the hard copy as a correspondence at 60 Centre Street. The filing receipt can be viewed by clicking this link; The Suffolk Efile document for this paragraph is Appendix 1 of 18 to DMRAMEX09152013 ¶ 3, "Filing Receipt August 12 2013 NY County Index # 100156/2011", Efiled Document #9.

The reason the New York County filing receipt this Paragraph 3 is a hardcopy is because the New York County Action, Index 100156/2011, has not yet been coverted to Efile. The Suffolk Action, Index 061458/2013, is an Efile case. Rosenblum looks to have the New York Action converted to Efile but August 11 2013 it was not Efile and presently 9/15/2013 it is not Efile yet- hence the above 8/12/13 receipt for New York County and this current 9/15/2013 Efile document for Suffolk County.

Since the August 11th Filing through to the second week in September 2013, there have been significant additional text added to this webpage, embedded below. DMR's full mid-September 2013 filing can be reviewed in PDF format as filed in NY State Supreme Court by accessing the Home page of the NY State Courts e-filing webpage at https://iapps.courts.state.ny.us/nyscef/Login and searching for New York State Supreme Court Suffolk County Index # 061458/2013 as a "Guest" if not registered, or by doing the same after logging in if registered. (Note in addition that the above captioned NY County action is not yet converted to Efile but facets of the case are available for review by accessing Web Civil Supreme on eCourts via New York State at https://iapps.courts.state.ny.us/webcivil/ecourtsMain and searching for the Index # 100156/2011 in NY County, New York Supreme. Alternatively, the filing can be reviewed in HTML format on the Internet by going to www.twentyfirstcenturydigital.com/amex.php, which is the content filed including all information connected to the page via hyperlink.

While my webpages {at blue links} may be edited following the mid September DMRAMEX09152013 e-filing with NYS Court in Suffolk by DMR; however, certainly, the 2013 E-filed PDFs will remain as filed in NY Supreme Court for the duration.

3.4

3.4 Rosenblum is a staunch advocate of the enforcement of contractual obligation, and Rosenblum is a staunch adcovate of the importance of the banking industry in capital economy. Rosenblum is a staunch advocate of the power of banking as a driving force for production, innovation, and efficiency in a capital economy. Rosenblum is a stauch advocate of entreprenuerial endeavor, entrepreneurial endeavor and innovation go hand in hand in a capital marketplace; and Rosenblum is Sole Proprietor of 21st Century Digital, which Rosenblum establised on December 9, 1996, by filing a DBA with the NY County Clerk's at 60 Centre Street NY NY. Please see concluding paragraph ¶ 33 below, for a link and Efile reference to the final Appendix #18 of 18, "Business Certificates: Daniel M. Rosenblum Sole Proprietor of 21st Century Digital, TTS Industries, and TMTP USA Unlimited." Appendix 18 of 18, Efiled Document #27.

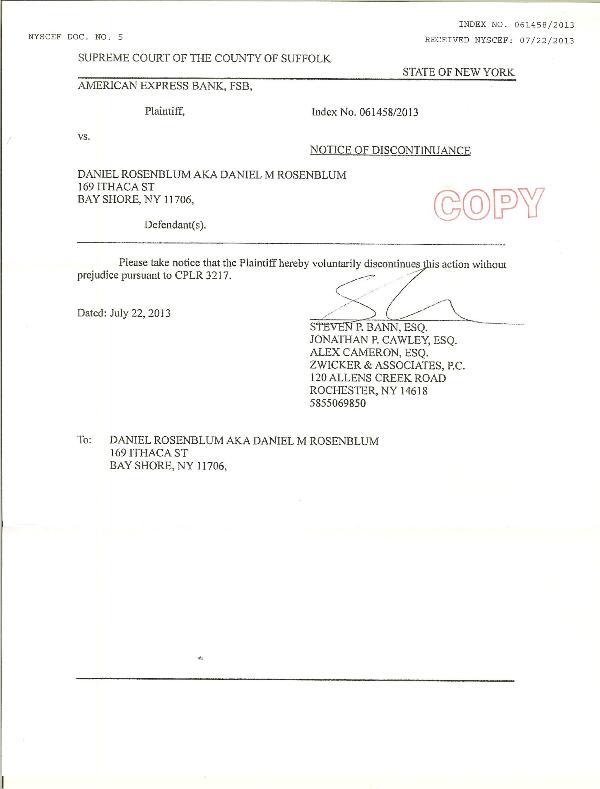

American Express v. Daniel M Rosenblum is an extant unresolved litigation in New York State Supreme Court in Index # 06145/2013 in Suffolk County and in New York County as a result of commencement of an action initiated by serving process of a Summons and Complaint on purchased Index Number by the Rochester Office of Zwicker and Associates, PC. The Index number of the unresolved litigation is 06145/2013. The subject matter of the litigation is American Express Hilton Honors Platinum Card 3713 392137 96009 exp.1/11, American Express claim against Rosenblum is $ 52,000.00 The Rochester Office of Zwicker & Associates filed a Notice of Discontinuance in this matter on July 15 2013, and paid a $ 35 filing fee to the Suffolk County Clerk causing the case file to mover from a status of Active to 'Disposed'. Rosenblum is of the understanding that Zwicker & Associates PC is ineligible to pay the filing fee for CPLR 3317 Notice and/or use such instrument as mechanism to discontinue in this matter, that a "Just" result to the litigation has not yet been achieved, nor has the matter been resolved, in particular given the self same subject matter in litigation in New York State Supreme Court, New York County as described in the below paragraph.

The above Suffolk Index # is an Efile case given mandatory EFiling in Suffolk County when this case was brought by Zwicker on June 20 2013, whereas the below New York Index Number Case file is not EFile given the case was brought in Manhattan March 2011 by Jaffe and Asher LLC.

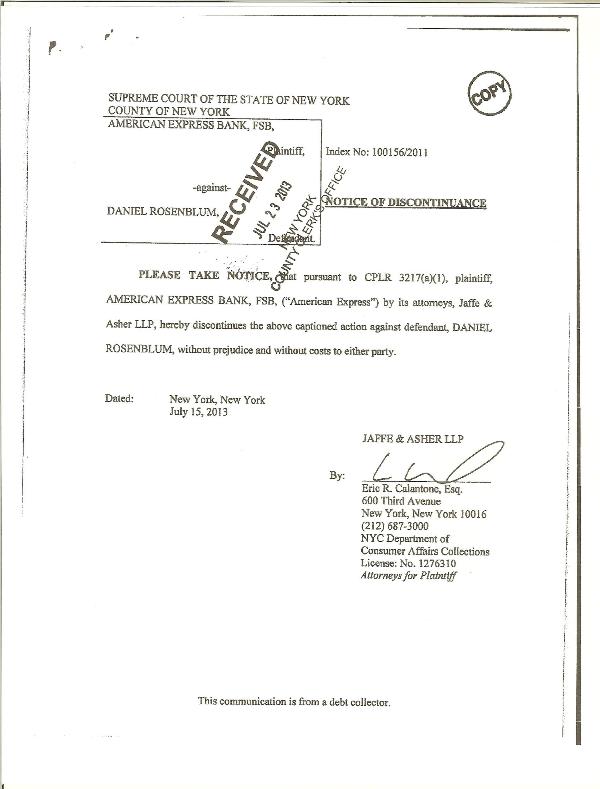

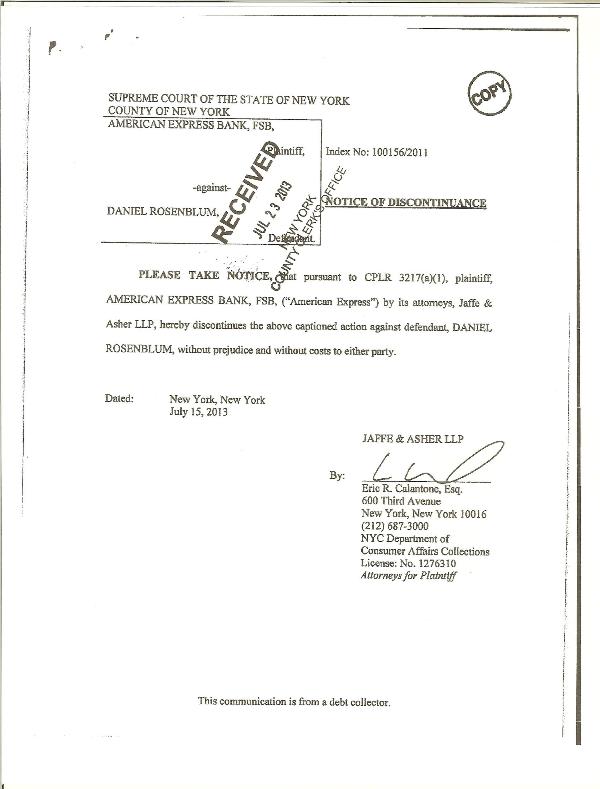

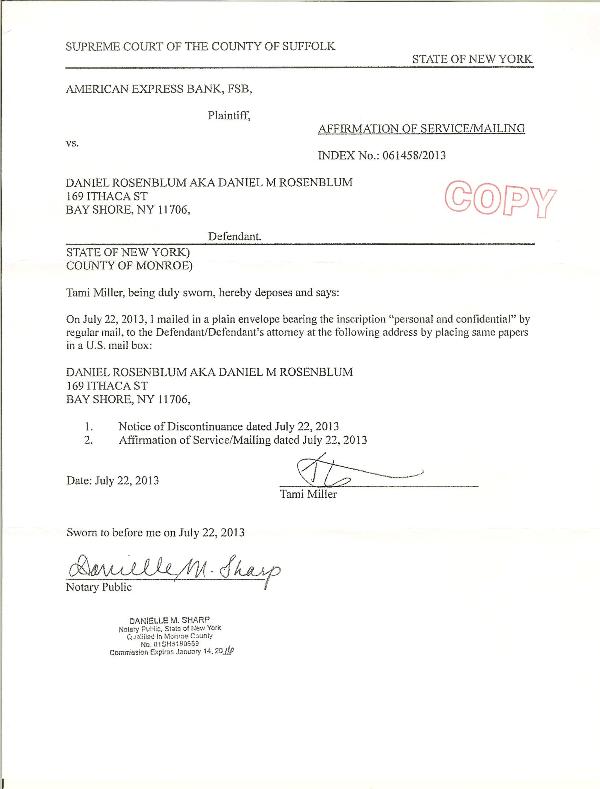

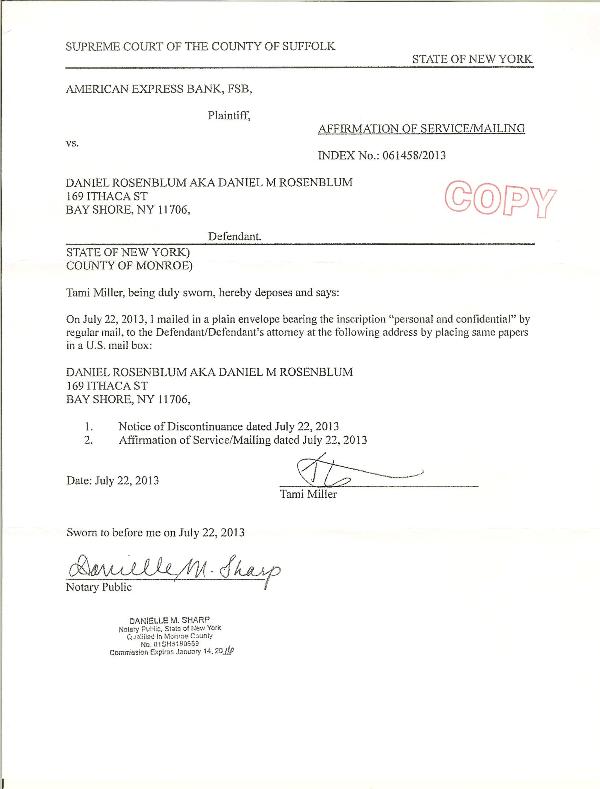

American Express v. Daniel M Rosenblum is an extant unresolved litigation in New York State Supreme Court in Index #100156/2011 in New York County as a result of commencement of an action initiated by serving process of a Summons and Complaint on purchased Index Number 100156/2011 by the law office of Jaffe and Asher LLC The Index number of the litigation is 100156/2011. The subject matter of the litigation is American Express Hilton Honors Platinum Card 3713 392137 96009 exp.1/11, American Express claim against Rosenblum is $ 52,000.00 The Law Office of Jaffe and Asher LLC filed a Notice of Discontinuance in this matter on July 22 2013, and paid a $ 35 filing fee to the New York County Clerk causing the case file to move from a status of Active to 'Disposed'. Rosenblum is of the understanding that Jaffe and Asher LLC is ineligible to pay the filing fee for CPLR 3317 Notice or use such mechanism to discontinue this litigation, that a "Just" result to the litigation has not yet been achieved, nor has the matter been resolved, in particular given the self same subject matter in litigation in New York State Supreme Court, Suffolk County as described in the above paragraph.

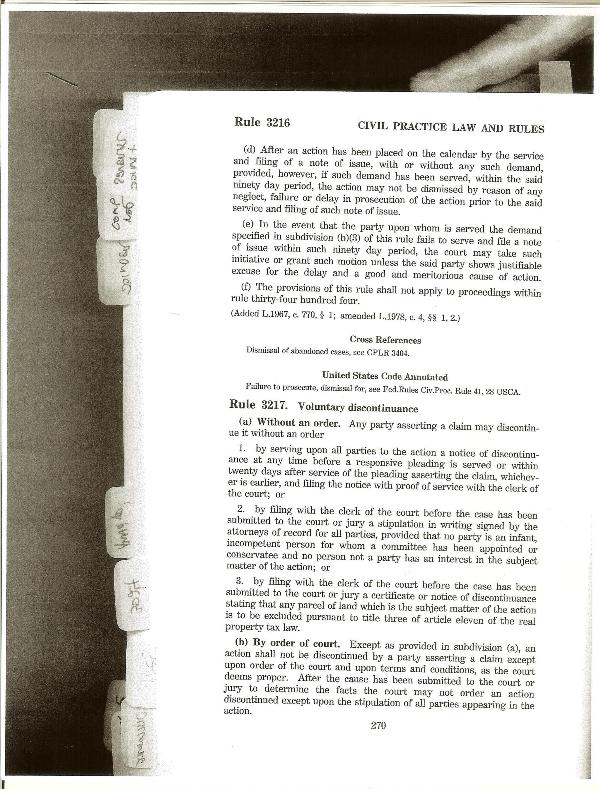

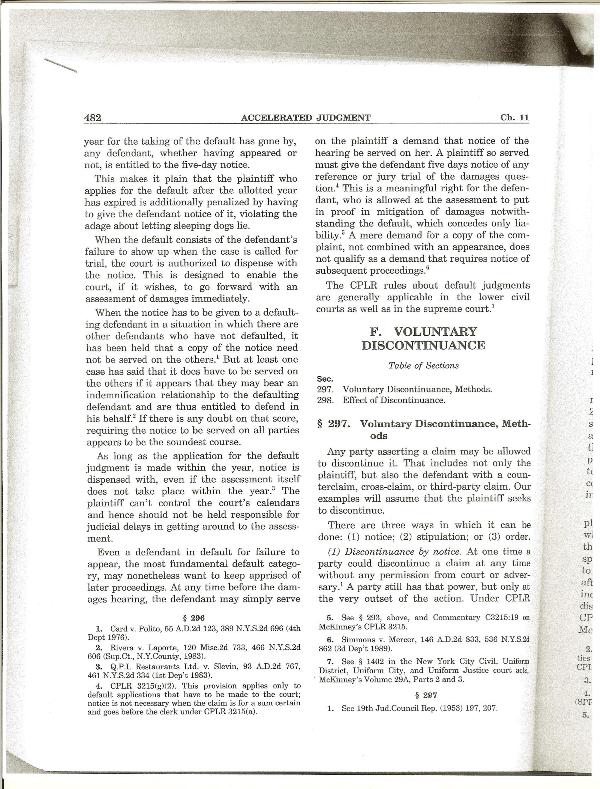

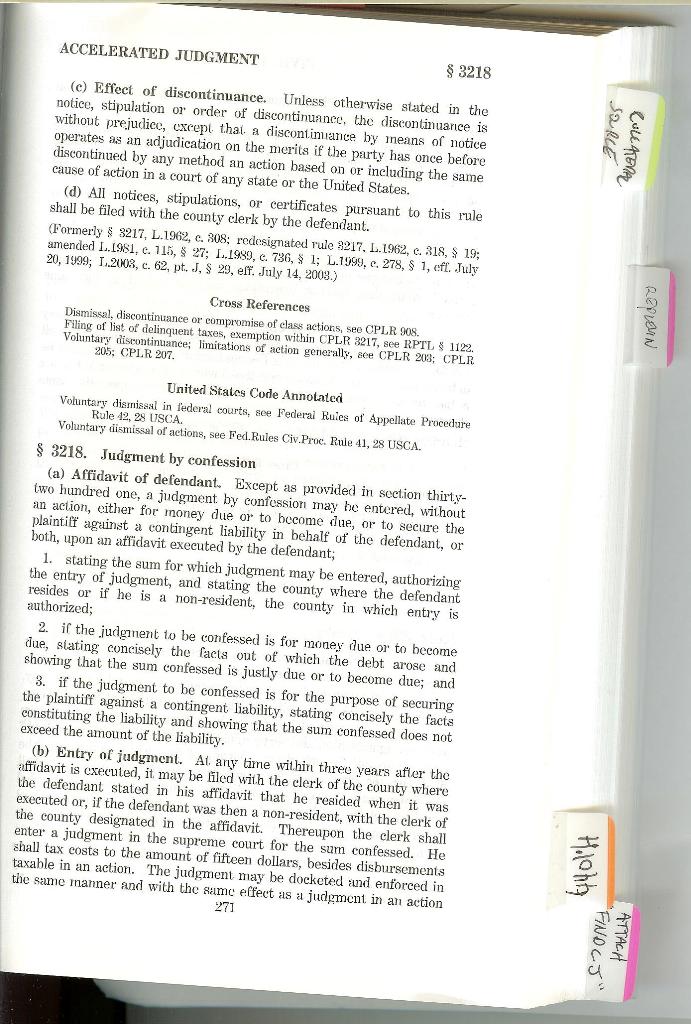

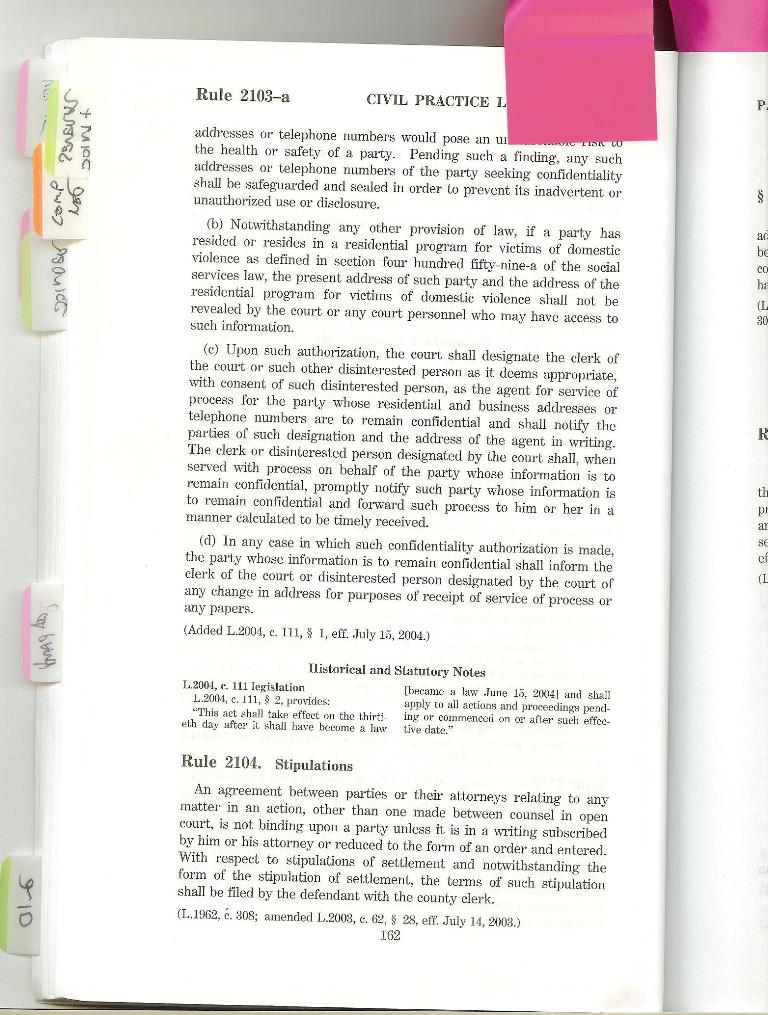

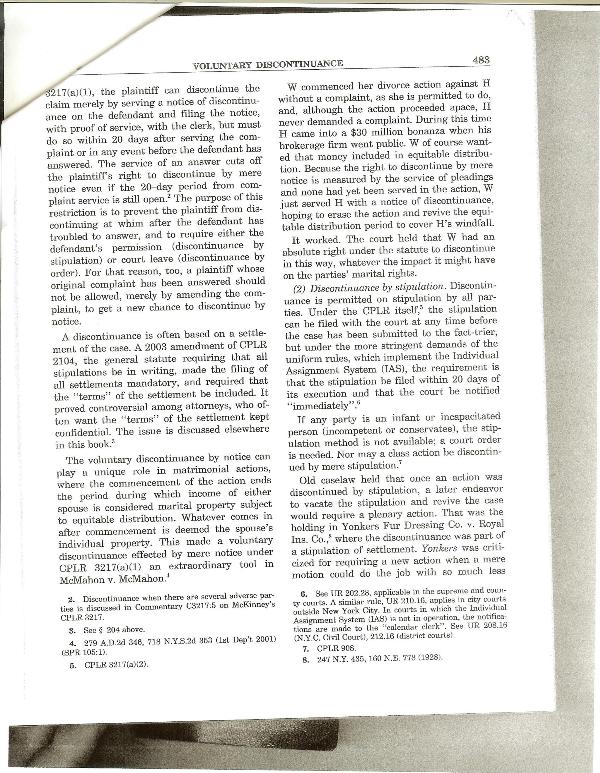

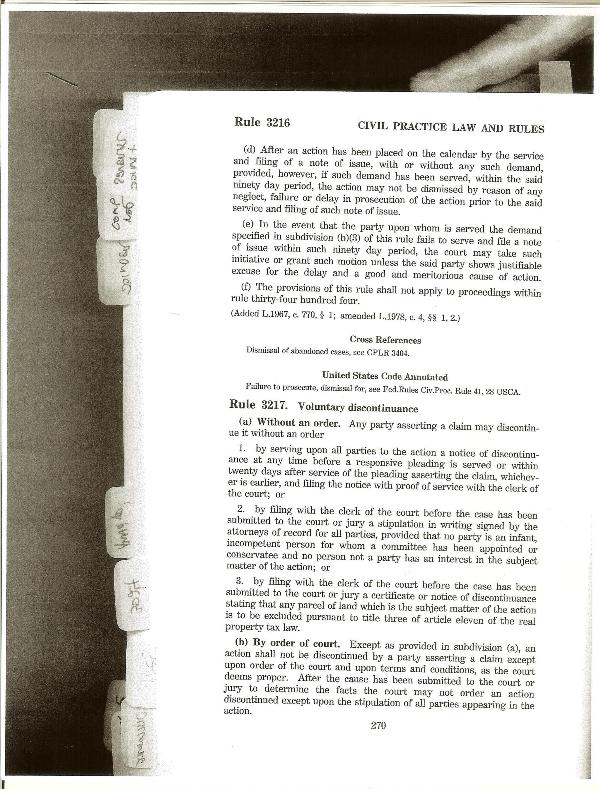

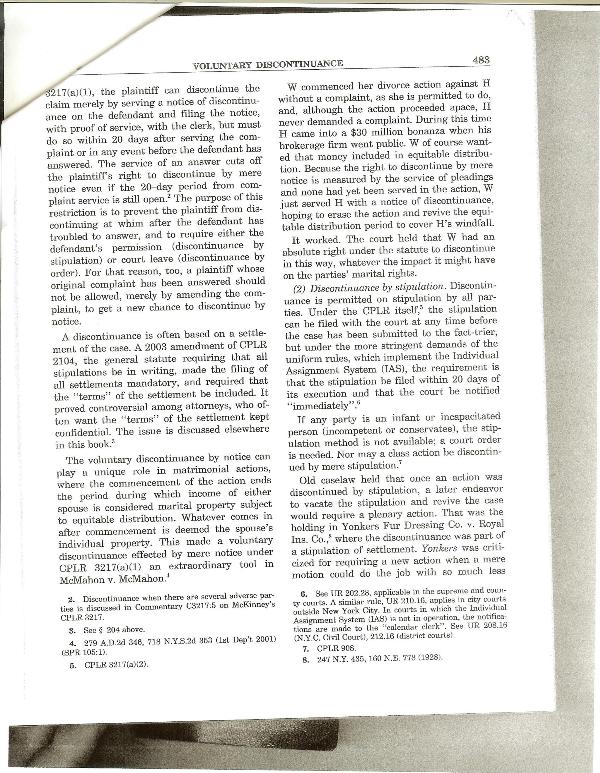

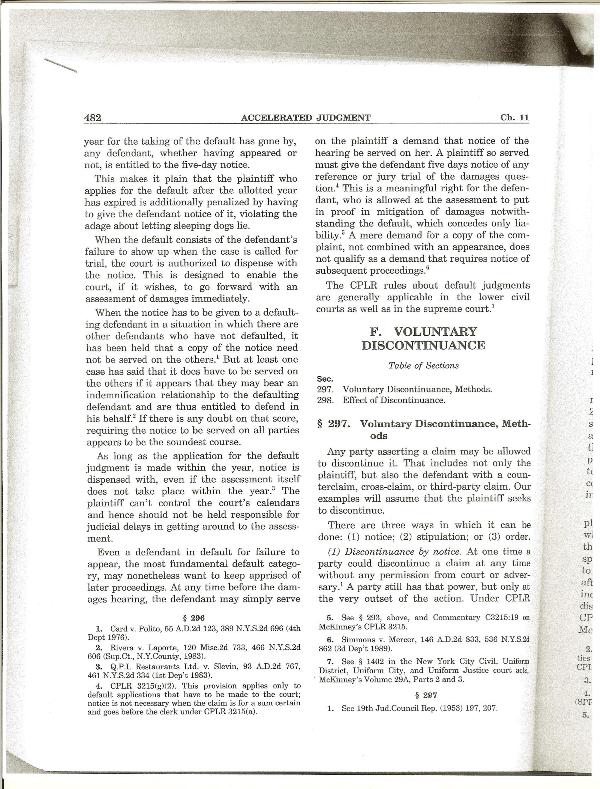

and, insofar as proper adjudication has not been had nor just result arrived at yet, Rosenblum is of the impression he is entitled to such result given commencement of action . DMR of the opinion that eventually this or any case should properly be subject to appeal and properly adjudicated. Here, presently , the status is one which changed to disposed without traditional review so the status of the case is one in which its in a no mans land- moved to disposed without judicial review or stipulation bypassing the rights of the defendant in all ways. Note in .there's nothing to appeal yet and there should be if a party is dissatisfied with a facet of the litigation; nor has their been any legally sanctioned mechanism or valid legal intrument initiated by the parties to the action which instrument could cause the case status to move from "active" to disposed". The CPLR specifically states that a filing fee for a stipulation of discontinuance MUST be paid by the defendant- ensuring that defendants in actions as a whole sum in the Court system are brought before the court 's authority by civil Plaintiff firms either are party to cases properly resolved by the State before a judge OR the parties have reached an agreement that the defendant is willing to pay a filing fee for. Otherwise Plaintiff firms become quasi-governmental agencies, similar to a district attorney filing a complaint. But the DA is subject to and follows the law as a quasi-judicial officer in the prosecutions of matters before the authority of the State court system. Here, the firms are Zwicker Associates or Jaffe and Asher filing Summons and Complaints and using the authority of the State to profit from default judgments but the same genre of legal actions are in sum not being reviewed by the Authoirty of the State, which purpose of review by the state in the judicial sytstem is to have an end sum "just result" politically and economically in the market where such actions are being brought before the court. In this type of action, Consumer Credit, these firms are not litigating to the benefit of the US economy but to the detriment of progress in the data processing market. That is to say, Rosenblum is of the understanding that proper legal adjudication of the sum of cases in which Zwicker, for example, used a 'null instrument CPLR §§ 3217' and paid a fee in contravention to the intents and purposes of the CPLR including CPLR §§ 3217 (d) {"All notices, stipulations, or certificates pursuant to this rule shall be filed with the county clerk by the defendant."} CPLR §§ 8008 CPLR §§ 8020(d) {"Filing a stipulation of settlement or a voluntary discontinuance……..pursuant to §§3217 (d), defendant shall file and pay $35 in supreme court and county court."} CPLR §§ 2104 Stipulations {"terms of stipulation shall be filed by the defendant with the county clerk."}. Justice is not served when such cases sit in a pile 'Disposed' but never having the subject matter of the cases in sum with proper legal advocacy immersed in the adversarial judicial process which has the cumulative efffect of justice in the arena or marketplace from whence the types of actions were borne. Here, Rosenblum, as per the 21st Century Digital Analysis/Critique, the action is borne in the arena of data processing by financial services companies- companies presumably, as 'banking entities' presumably engaged in the commerical services of loans, discounts, deposits, and trusts. Here, Rosenblum is stating as well that the Zwicker firm may be misleading its client by claiming to have 'resolved in the eyes of the State' the countless cases which are marked as disposed but are active under the Rosenblum analysis above. Or, perhaps Amex is aware of the Zwicker practice described (and other such firms similar to Zwicker doing the same thing), and in such scenario Amex is aware and believes the Zwicker practice pertaining to 'disposed' cases and CPLR §§ 8008 CPLR §§ 8020(d) §§3217 (d), and CPLR §§ 2104. Perhaps Amex General Counsel would argue that the contracted firms' interpretation and use of CPLR §§ 8008 CPLR §§ 8020(d) §§3217 (d), and CPLR §§ 2104 is legitimate and should cause the status of the case to move to disposed from active- and that all Zwicker's settlement negotiated and related release and waivers are valid.

For the reasons stated above, and variously throughout this filing, the cases 061458/2013 and 100156/2011 are not disposed. And, if the Zwicker firm had led one or three or even 10 litigants over the course of a significant time period to believe that the 3317 Notice filed by Zwicker following 20 days or after any responsive pleading terminated the case, perhaps such error might be excusable as a law firm error. However, the bottom line is that Zwicker has made an operational decision to misrepresent the CPLR and the weight of their repeated filing to litigant after litigant; the practice is a tactical strategy, and is reprehensible in the industry under analysis in particular given the Rosenblum analysis including 21st Century Digital criticism taking into consideration Permissible Activities and Tying Law for commercial entities, namely banks, engaged presumably primarily in the commercial, regulated, banking activity of loans, discounts, deposits, and trusts- and utilizing the canon of law associated with such status to utmost advantage in the marketplace.

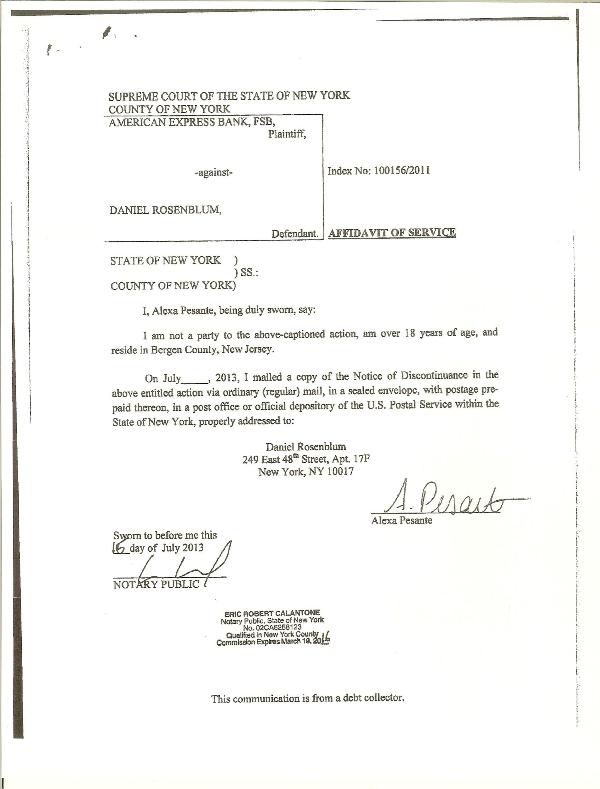

Defendant Rosenblum filed address change notification on Index # 2011 in the 60 Centre Street case file switching address from 249 East 48th Street NY NY to PO Box 3377 NY NY 10163 on April 29th 2011; Rosenblum continues to receive mails at such address, and has since June 1996. Rosenblum accepted the Manhattan venue, no motion for change of venue has been made, yet; Zwicker Summons and Complaint initiated the Suffolk action. Note that Jaffe & Asher failed to mail ANY materials the changed address, ever, 2011, 2012, 2013 continuing- Jaffe has only has mailed to 249 East 48th.

Note that Defendant Rosenblum has moved his residence to Suffolk County during late Spring 2010 but continues to litigate the NY Action and has never challenged venue, nor has motion been made to change venue by any party. While Rosenblum rides his bicycle every day to work seven miles from Islip to Central Islip and passes the Suffolk Courts on Carleton Avenue in Central Islip every morning (and again 7 miles en route to home in the afternoon; Rosenblum owns no vehicle and is relatively ineligible to rent a vehicle given no credit card). However, the Suffolk Riverhead Courts are very difficult to get to in timely fashion, Rosenblum has no vehicle. Service to Manhattan and Centre Street is very reliable using LIRR and MTA Subway. Rosenblum is very familiar with the venue, having a done an internship at 60 Centre while at NY Law. Rosenblum has business certificates on file for 21st Century Digital at 60 Centre Street. Rosenblum answered at 60 Centre. Rosenblum accepted venue. Rosenblum opposes change in venue if motion made by Amex or attorney claiming to represent. Note that, as per the paragraph below on "Intended Calendar", Rosenblum looks to have the NY County case converted to EFile. However, it is uncertain presently how the Courts will deem the Notices of Discontinuances filed in NY and Suffolk, and, Rosenblum accordingly Efiles in Suffolk presently and will do the same in NY once the case is converted or will do so in hard copy if Plaintiff American Express is reluctant to change the case to Efile (see "Intended Calendar" below).

Please note that defendant litigant Rosenblum is not litigating to be a protector of debtor's rights; nor do I advocate some procedural maneuver to circumvent obligation by any party, whether plaintiff or defendant; rather, I litigate and insofar as I advocate jurisprudence as it pertains to banking and data processing. I am sole proprietor of the business entities 21st Century Digital, TTS Industries, and TMTP USA Unlimited. As such, I advocate an analysis in the marketplace which considers in detail two fundamental banking regulatory axioms- 1) tying in banking, and, 2) permissible activities in banking. And I analyze here now- critique in part here now- insofar as the law goes- the attorney firms litigating on American Express' behalf given privity in an action(s) the firms commenced. Please see the 20 Series of Paragraphs § ¶ 20.4 ¶ 20-22 below for further articulation of the 21st Century Digital Analysis and Critique as it pertains to Banking, Regulation, Permissible Activities, and Tying.

Presently, Rosenblum advocates and litigates towards a correction to Zwicker and Jaffe's erroneous, flawed, detrimental litigation practices as those practices, in Rosenblum's view, are part and parcel of an economic problem holding back greater commerce in the US marketplace- the practices of the firms are detrimental to the US economy in the end. Here, now, Rosenblum is of the opinion that the practices of major firms in mainstream banking should be in accordance with the highest precepts and axioms of justice. Presently, Rosenblum suggests that scrutiny of the firms' practices, in light of the instant filing, is in order. Note that Rosenblum has also filed a document today proposing alternative "just results". One scenario permits the firms to self correct the subject matter Rosenblum critiques over an 18 month period. That is, Rosenblum would agree not to litigate his critique of the Plaintiff attorney firms for the 18 month period following which time Rosenblum would be free to litigate the same subject matter if the same practices were being utilized and the additional practices Rosenblum advises were not implemented.

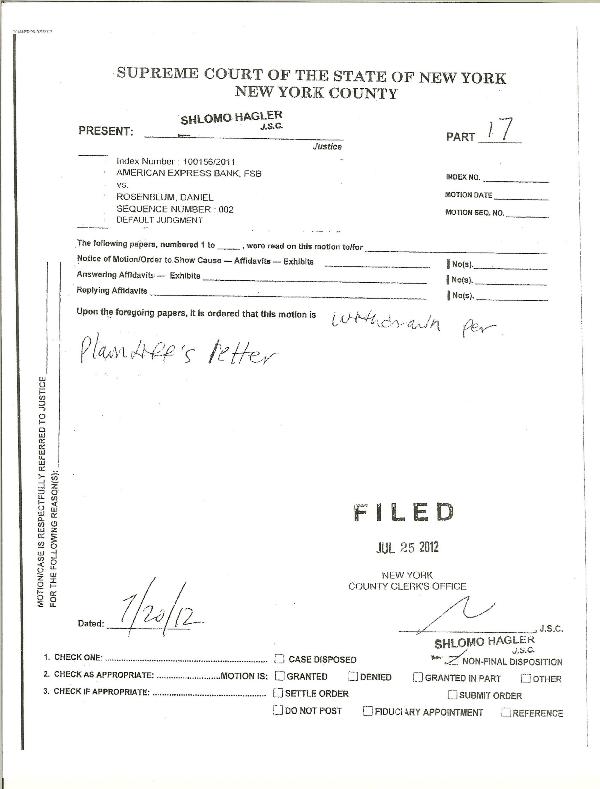

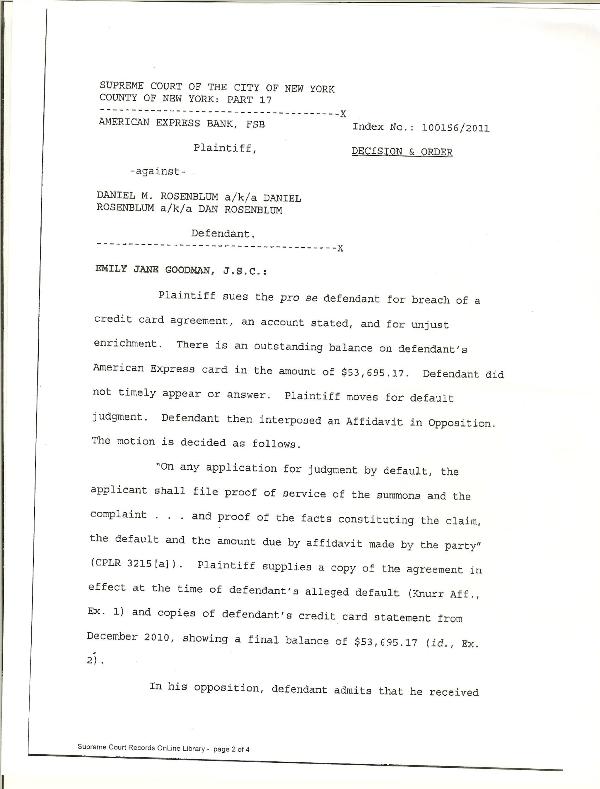

Note the documentation below that both firms, Zwicker P.C. and Jaffe LLP, utilized CPLR 3217 in an effort to discontinue the two above captioned New York State Supreme Court identical subject matter actions in New York County and Suffolk County within one week of each other, although firm Jaffe and Asher brought the New York action 1st quarter 2011 and Rochester Office of firm Zwicker brought the Suffolk action the week before July 4th 2013.

Rosenblum hereby states that Rosenblum has indicated to Zwicker attorneys and Jaffe attorneys that Rosenblum intends to file comment on the Zwicker firm and the Jaffe firm with the appropriate Departmental Disciplinary Committees regarding firm and attorney compliance with the NY Rules of Professional Conduct, and to bring certain matters here discussed to the attention of the Office of Court Administration. As it stands, it seems neither firm was eligible to utilize the CPLR 3217 mechanism, below are images of the text of the CPLR Section and the firms' filings. As it stands, Rosenblum is of the opinion that both firms are also neglecting a variety of facets of the The New York Rules of Professional Conduct and the New York Civil Practice Law and Rules ("CPLR"). Rosenblum is of the opinion and understanding that some of the firm(s)' violations of the CPLR and the Rules of Professional Conduct are more egregious than others, and that the violations accrue to individual attorneys at both firms and to the Officers and Supervisors at both firms. Presently, in the the instant matter, Rosenblum is of the opinion that in both Suffolk County and New York County he is entitled to "just results" in both actions in Suffolk and Manhattan. If discontinuance is desired by the firms and Plaintiff, than Rosenblum is entitled to a Stipulation of Discontinuance from Zwicker and from Jaffe (or, if discontinuance is not desired by the Plaintiff and Plaintiff firms, then, litigation and adjudication- or- an accurate file record which indicates why and how the case was properly disposed). Rosenblum is also of the opinion that violations by the firms need be addressed and corrected in all the firms' other cases too, specifically when it comes to Discontinuances and Firm Diligence. Below on this page I do not further address in detail the specific subject matter regarding a "just result" in the instant matter; nor on this page do I delve further into the firm(s)' culpability regarding lack of appropriate attorney supervision etc. Rather, please click here for a webpage devoted to a "just result" in the instant actions in Suffolk and Manhattan, or similarly please refer to {DMR#4} Appendix 2 of 18 to DMRAMEX09152013 "DEFENDANT PROPOSED "JUST RESULTS" PRESENTLY: JUDICIAL STAY OF PROCEEDINGS ON DEFENDANT’S FUTURE MOTION OR STIPULATION BETWEEN PARTIES. , Efiled Document #10, where, Defendant Rosenblum discusses and proposes two alternative "Just Results" in the present action, at Appendix 2 Paragraph 8-14, discussing both cases 100156/2011 and 061458/2013.

6.1 And, please click here for a page addressing the subject matter of the firm(s)' misuse of the CPLR and violation of the New York Rules of Professional Conduct, or see Appendix 3, REGARDING POSSIBLE VIOLATIONS OF NY CPLR AND NY MODEL RULES OF PROFESSIONAL CONDUCT BY THE ZWICKER FIRM AND JAFFE FIRM IN THE CAPTIONED ACTIONS, which is Appendix 3 of 18 to DMRAMEX09152013 ¶¶ 6.1 and ¶ ¶ ¶ Subject: POSSIBLE ABUSES OF NY CIVIL PRACTICE LAW AND RULES, AND NY MODEL RULES OF PROFESSIONAL CONDUCT BY AMEX ATTORNEYS: ZWICKER FIRM AND JAFFE FIRM IN THE CAPTIONED ACTIONS. Efiled Document #11.

Bringing an action in a court of law subjects both the plaintiff and the defendant to certain scrutiny, and, if the plaintiff or plaintiff's attorneys, particularly the attorneys, have been involved in corrupt/illicit practices, such practices are certainly subject to scrutiny . Here, the proper termination of American Express vs Daniel M Rosenblum is an adjudication, a judicial order or a stipulation, and, until such time, the plaintiff's attorneys actions brought to bar in this action are certainly subject to scrutiny under the purview of New York State Supreme Court. Daniel M Rosenblum is entitled to a proper termination of the action against my person without a violation of my rights in the action, including a right to discovery, a right to an adjudication of the issue brought to bar by the plaintiff and related issues brought to bar by defendant in consideration of plaintiff's suit .

American Express v. Daniel M Rosenblum is an extant unresolved litigation in New York State Supreme Court in Index # 06145/2013in Suffolk County and in New York County as a result ofcommencement of an action initiated by serving process of a Summons and Complaint on purchased Index Number by the Rochester Office of Zwicker and Associates, PC. The Index number of the unresolved litigation is 06145/2013. The subject matter of the litigation is American Express Hilton Honors Platinum Card 3713 392137 96009 exp.1/11, American Express claim against Rosenblum is $ 52,000.00 The Rochester Office of Zwicker & Associates filed a Notice of Discontinuance in this matter on July 15 2013, and paid a $ 35 filing fee to the Suffolk County Clerk causing the case file to mover from a status of Active to 'Disposed'. Rosenblum is of the understanding that Zwicker & Associates PC is ineligible to pay the filing fee for CPLR 3317 Notice in this matter, that a "Just" result to the litigation has not yet been achieved, nor has the matter been resolved, in particular given the self same subject matter in litigation in New York State Supreme Court, New York County as described in the below paragraph.

The above Suffolk Index # is an Efile case given mandatory EFiling in Suffolk County when this case was brought by Zwicker on June 20 2013, whereas the below New York Index Number Case file is not EFile given the case was brought in Manhattan March 2011 by Jaffe and Asher LLC.

American Express v. Daniel M Rosenblum is an extant unresolved litigation in New York State Supreme Court in an Index #100156/2013 in New York County as a result of commencement of an action initiated by serving process of a Summons and Complaint on purchased Index Number 100156/2013 by the Rochester Office of Zwicker and Associates, PC. The Index number of the litigation is 06145/2013. The subject matter of the litigation is American Express Hilton Honors Platinum Card 3713 392137 96009 exp.1/11, American Express claim against Rosenblum is $ 52,000.00 The Rochester Office of Jaffe and Asher LLC filed a Notice of Discontinuance in this matter on July 22 2013, and paid a $ 35 filing fee to the New York County Clerk causing the case file to move from a status of Active to 'Disposed'. Rosenblum is of the understanding that Jaffe and Asher LLC is ineligible to pay the filing fee for CPLR 3317 Notice in this matter, that a "Just" result to the litigation has not yet been achieved, nor has the matter been resolved, in particular given the self same subject matter in litigation in New York State Supreme Court, Suffolk County as described in the above paragraph.

If litigation is to commence anew in the instant matters in NY and Suffolk, Rosenblum is of opinion that he is entitled to discovery insofar as all matters here discussed until such time that litigation is properly terminated in each matter either through Stipulation or Judicial Order. DMR has filed today one Notice of Discovery, which Notice is primarily discussed below in Paragraph 16, which informs that my September 15 Notice of Discovery is {DMR#11} Appendix 9 of 18 to DMRAMEX091513 ¶ 16 ¶¶¶¶¶¶¶¶¶ REGARDING AMEX FIRM PHONE RECORDED EVIDENCE & COMMUNICATIONS TECHNOLOGY GENERALLY; FIRM/&LENDER OPERATIONAL COST&POLICIES SACRIFICING DILIGENT LEGAL PRACTICE. Efiled Document #17 and which can also be viewed via Internet clicking here.(see paragraph 16 below and associated Appendices)

It is the understanding of Daniel M. Rosenblum that the Jaffe Notice of Discontinuance filed in New York County is basically a nullity. It is the understanding of Rosenblum (although it is not certain because Rosenblum is not familiar with all aspects of what occurred nor what the Court prefers) that Jaffe (and other Plaintiff firms) are simply filing Notices of Discontinuances and paying a fee with the County Clerk which has the effect of changing the "status" of active cases to "disposed" without any Judicial oversight. It appears to Rosenblum that the change in status in these instances are merely administrative occurrences without any actual weight in the Justice system, but that in fact these Plaintiffs are not entitled to such mechanism or administrative change in status, and, in the eyes of the law, the case file is actually administratively "active" because the Notice of Discontinuance is invalid- a nullity. As noted in the Paragraph above on CPLR and NY Professional Conduct, I have a webpage on this subject matter. Here, the notion that the Notice of Discontinuance is a nullity is stated only because therefore the case remains active, and, it is the intention of Rosenblum, as it always has been, to eventually file a full Motion to Stay Proceedings, or, a "Tolling Motion". And, it is here noted, Rosenblum has already filed a correspondence in the New York Index file 100156/2011 on August 12 2013 indicating the same.

Please note, as part of my Affidavit in Support of my Amex tolling motion I intend to file my June 26th, 2002 "Tolling Motion" which I originally filed in East Hampton Village Justice Court, requesting the court to "stay" or "toll" or "stop the clock" on all statutes of limitations associated with a speeding ticket I received for a ticket I got going 6 or 7 miles per hour over the Village Speed Limit of 25 MPH on Dunemere Road in the early afternoon on an autumn weekday while I was working for the Hampton International Film Festival during October 2001. Given the circumstances articulated in the 2002 Tolling Motion, I was unable to prudently pay the $130 speeding ticket. Click to review on the Internet, or, see Efiled Document # 12, Please see {DMR#6} Appendix 4 of 18 to DMRAMEX09152013 ¶ 9 ¶ ¶¶¶¶¶¶¶¶¶. Subject : TOLLING MOTION SUPPORT: June 26 2002 EAST HAMPTON VILLAGE TOLLING MOTION AS BASIS FOR NEW SIMILAR MOTION TO STAY PROCEEDINGS Efiled Document #12

Please note, at the time of compiling materials for this instant webpage during July and August of 2013 I had not completed any filing in New York or Suffolk but had begun preparation of several sorts of filings since the inception of both actions. However, also, to date I had never received actual Notice of any proceeding, except for the original Summons and Complaint, in the New York County action until after the proceeding. Please note that I had timely filed a Change in Address in New York County soon after the action commenced, which is in the New York county File and NY State Courts computer system since the Address Change, but the same New York County Court file demonstrates that even though the administrative change was accurate, the court sent mailings to the wrong zip code, and, the plaintiff continued through 2013 to send materials only to the old address from before the address change. The main filing I am seeking to generate is my tolling motion and supporting documents- but resources to do so are quite limited, albeit that I do slate work on the matter in stages, such as I did during July 2013(here is a link to my July 2013 webpage, which explains its own purpose. As there noted, I did not complete certain tasks slated for that page due to the Zwicker filing in Suffolk. Rather, I got started on answering the Zwicker complaint and continued following up on the Jaffe complaint) or view the same materials at the Eile version , {DMR#7} Appendix 5 of 18 to DMRAMEX09152013 ¶ 9 et. al. & ¶¶¶¶¶¶¶¶¶ Subject : my "July 2013 Webpage Materials; MATERIALS/webpage titles by Defendant Rosenblum as “July 2013 Materials”, relevant in many ways to Amex v Rosenblum" Efiled Document #13. See also §§¶¶ 31, 32, 33 below regarding Sole instance Rosenblum previously registered Attorney complaint regarding NY Model Rules of Professional Conduct, in 1997.

[[regarding §§¶¶ 9 on "tolling" : in effect the doctrine of statute of limitations is a temporal limitation placed on legal matters; in this instance, in my motion I am applying the legal terminology of statute of limitations to designate the expiration of a legal time limit imposed on all matters relevant to the matter at bar, including but not limited to the filing of a tolling motion, the filing of a joinder, the filing of an answer, the filing of a counter claim, the filing of an appeal, and any other matter related to the instant case, effectively stopping the clock retroactively, an action recognized in the legal canon in the school of tolling statutes of limitations, as identified below]

Note of utmost importance as supplement to any tolling motion, as well as any item of information on this page, is the informational supplement attached hereto from my webpage, "www.twentyfirstcenturydigital.com/TTSMay1996toMay2012.php. The page was originally published as a 12th Anniversary Webpage memorializing a chronology of events 1996-2012, but subsequently the work there done is a historical chronology describing the establishment of TTS Industries and 21st Century Digital during 1996, the business agenda, the history of the trademark 21st Century Digital, the patent application for a 21st Century Digital network, Daniel Rosenblum's articles on the nexus between banking and digital commerce, and hurdles/obstacles during the first decade of attempted operations, and can be viewed as Appendix 6, Efiled Document #14, "TTS Industries established May 20 1996 by DMR at NY County Clerk's Office, 60 Centre Street, NY NY, historical perspective" {DMR#8} Appendix 6 of 18 to DMRAMEX091513 §§¶¶ 9, really applicable to all paragraphs, her introduced ¶¶¶¶¶¶¶¶¶ Subject : "TTS Industries established May 20 1996 by DMR at NY County Clerk's Office, 60 Centre Street, NY NY, historical perspective" Appendix 6 of 18, Efiled Document #14.

Given all the above information, Rosenblum has an intended calendar insofar as dates by which he intends to make certain filings or send correspondences (which can be viewed by clicking here or pleases see in the Efile at New York State Court, Suffolk County Index # 061458/2013 American Express v Rosenblum, Appendix 7 Efiled Document # 15, "ROSENBLUM INTENDED CALENDAR IN THIS ACTION") to attempt achieve one/any of the above articulated "just results" see Appendix 2, Please see {DMR#4} Appendix 2 of 18 (for DMRAMEX091513-paragraphs ¶ 6 , ¶ 7 ¶ 4 ¶ 10 ¶¶¶¶¶¶) Subject: DEFENDANT PROPOSED "JUST RESULTS" PRESENTLY: JUDICIAL STAY OF PROCEEDINGS ON DEFENDANT’S FUTURE MOTION OR STIPULATION BETWEEN PARTIES. , Efiled Document #10.

Oddly, however, the Offices of Jaffe and Asher, attorney for Plaintiff American Express, has filed with the New York County Clerk a "Notice of Discontinuance" purportedly in accordance with CPLR 3217(a)(1). Similarly, the firm of Zwicker and Associates filed the same notice citing the sae CPLR within a week of the Jaffe Discontinuance with the Suffolk County Clerk. In one respect the Zwicker CPLR 3217 Notice of Discontinuance might be considered a valid filing given that by some calculations their Summons and Complaint might be calculated to be within 20 days of their service of summons and complaint. However, that seems only if their Summons and Complaint were actually a valid legal filing, due to the fact that I had told Zwicker over several months that the subject matter was in New York Court. On the other hand, the Jaffe Discontinuance comes over two years following my responsive pleading, an Affidavit in Opposition filed April 2011. Below I have images of most of the pertinent filings in the current matter in New York Supreme Court Index # 100156/2011. Specifically, there are images of the Zwicker and Jaffe Discontinuance notices of July 2013, decisions in the Index file by Judges Goodman and Hagler, my April 2011 Affidavit in Opposition, the Zwicker June 2013 Summons and Complaint, and one or two more items from the case file. I am the defendant in the matter, and am Pro Se.

Lastly, below, interdispersed with some of the images of the New York County Index 100156/2011 file are some commentary by me and links to documents I intend to file in the matter in support of my tolling motion; this is because I am of the strong understanding that the just result in this legal action is a stay of all procedure until such time that I can pay American Express in full, as described and because of what is described variously below and in the supporting documentation:

12 Note that the date of the Jaffe above discontinuance in NY County is July 15, 2013, which is one week prior to the below Zwicker CPLR 3217 Discontinuance dated July 22nd. Note that the above Notice of Discontinuance is more than two years following the Jaffe Summons and Complaint which commenced the action, which Index file contains two judicial decisions and Rosenblum's Affidavit in Opposition. The attorney filing the Discontinuance obviously is unfamiliar with the CPLR 3217 statute on several aspects of the statute, and his supervisors at Jaffe also have been remiss in proper supervision when it comes to diligent filings in court actions (below on this webpage is copy of the CPLR 3217 text and New York Practice Commentary which demonstrate why the Plaintiff firm is ineligible to file the above Notice given the case file). Note also that the above Jaffe Discontinuance is signed by Eric Calantone of Jaffe, and that Calantone also served as Notary to the Service of such Notice, in the image below. Note also that Calantone, in the case file at 60 Centre Street, filed a second RJI more than a year after the firm Jaffe filed a previous RJI, and that while doing so Calantone swore that no previous RJI had been filed in the matter, even though it was evident in the case file that a previous RJI had been filed. Note that Rosenblum had dialogue with Kevin T. Udy of American Express, a Senior Manager of American Express Global Credit Administration on July 15th. Rosenblum was referred to Udy by a Senior Manager in the Office of the General Counsel at American Express approximately 10 days earlier.

Also insofar as the above Jaffe Notice of Discontinuance, which Jaffe as Plaintiff firm was ineligible to file, is not unique. A preliminary, quick review of Jaffe cases before New York State Supreme Court indicates that Jaffe is regularly filing 3217 Notices in cases where Jaffe is ineligible to make such filings. The filings are paid for at the Cashier in New York State Supreme Court, causing the cases at bar to change in status from "Active" to " Disposed" without Judicial Review, for a fee paid to the Cashier of $ 35. In my case, following such transition, the Jaffe law firm then began to solicit from me what they refer to as a "Waiver of Release" releasing American Express from any potential liability in the case, and releasing me from any debt owed to American Express. This is, I believe, in violation of the NY Rules of Professional Conduct as the firm must know that Notices of Discontinuances are invalid, yet, they are using the Notices and change of status in the Court system as a bargaining tool with defendants. In one respect, all "Waivers of Release" secured by Jaffe (or Zwicker, for that matter; see below) following invalid Notices of Discontinuances filed by the Plaintiff firm should be null and void as they were secured under false pretenses. Similarly, all settlements in cases with Notices of Discontinuances should be null and void with prejudice against Zwicker and/or Jaffe. The reason Rosenblum suggests this is because Rosenblum is of the opinion that the practices presently firms such as Zwicker and Jaffe are harmful to the American economy in a variety of ways. A significant facet of the dilema at bar is that lenders such as American Express, Visa, and Mastercard are lending in an unproductive manner and are not subject to true market conditions that such lenders should be subject to. If these lenders had the full costs associated with litigation, including decisions on the merit setting precedent- they would lend more wisely. Similarly, these lenders are not subject to true market conditions as a result of their non-banking revenues in processing transactions resulting in more than half a trillion dollars in revenues annually while also functioning as lending banks. More on this subject at the 21st Century Digital Webpage devoted to the recent Federal District Court decision concerned with debit card interchange fees or "swipe fees" charged by Visa and Mastercard for processing transactions using digital technologies, the full July 31st 2013 decision by Judge Richard Leon in the matter of NACS v. Board of Governors of the Federal Reserve System, 11-cv-02075, U.S. District Court, District of Columbia (Washington) which can be viewed and is filed herewith as NY State Supreme Court, Suffolk County Index # 061458/2013 Efiled Document #16, {DMR#10} Appendix 8 of 18 to DMRAMEX091513 introduced in §§¶¶ 12 discussed various ¶s including ¶ 20 below & ¶¶¶¶¶¶¶. GENERALLY: PERMISSIBLE ACTITIES, TYING IN BANKING INDUSTRY. DURBIN AMENDMENT TO DODD FRANK ACT, 21ST CENTURY DIGITAL, Efiled Document #16.

Below, Paragraph 20 et al articulates additional related information concerning the nexus between Dodd Frank Durbin and the Permissible Activities Doctrine and the Antitying Doctrine as it pertains to commercial entities, namely 'banks' presumably primarily deriving revenues from the commercial services of loans, discounts, deposits, and trusts while also engaged in processing data for fees- and the practices of attorney law firms litigating consumer credit actions on behalf of those same banking entities.

However, in this paragaph here Rosenblum is primarily concerned only with the improper filings by the Plaintiff firms Jaffe LLC and Zwicker PC, which firms, given such filings, should be viewed with caution.

13 American Express as lender must have an expectation of earnings by the borrower associated with the dollar amount loaned or on loan or granted as credit, approved as credit. Here, what would have been the average expectation of earnings associated with a $36,000.00 line of credit? Over a 5 year, 10 year, or 15 year period average expected earnings per borrower ? I have discussed with Hoeffherr at Jaffe, as well as with representatives of Amex and Zwicker and Jaffe the notion that I intend to pay American Express back, and that the 'just" adjudication would have me do so when earnings are at least in line with projections for earnings expectations associated with a $36,000.00 line of credit. I have discussed with Hoeffherr at Jaffe as to the Credit Reporting Agencies and this line of credit and my inability to rent a car nationwide, as well as the fact that I do not own a motorized vehicle but rather use a bicycle for my seven mile commute to work daily. Further, I have indicated that when my income goes up from $ 14.75 per hour to purchases of a vehicle and perhaps even home ownership should take precendence over an alottment of monies to American Express and Jaffe and Asher if there were a default judgement. In a few pages from now, is an image of my nine page April 2011 Affidavit in Opposition.

I have discussed with Hoeffherr at Jaffe the notion that at Zwicker and Jaffe these "law firms" have applied a cost benefit analysis to debt collection which is impermissable. That is, as businesses their analysis determined it is more profitable to devote scarce resources to filing summons and complaints rather than to the diligence required by attorneys in the practice of law and interaction with the courts and judicial system. (that is to say, perhaps a five star michelin guide restaurant can cut costs by opening a chain. In cutting costs, the quality may go down. Jaffe is not entitled to simply suffer the consequences the way the restaurant does given that clientele might dine elsewhere. Jaffe may not cut costs which sacrifice diligence in the practice of law as technology has advanced. Scarce resources of a firm must first be devoted to diligent practice of law, and only then can the additional resources be devoted to profit increasing measures- which always should come second to diligence. No actual diligece should be sacrificed because scarce resources have been priortized towards profit increasing measures such as spending on dial-out phone systems, or dial-out phone systems which can record dialogue with a borrower presumably in accordance with some debtor law disclosed by Zwicker Associate dialers. In no instance in the collection process does a borrower have the option to have recorded dialogue available albeit Zwicker or Jaffe purportedly utilizes recorded telephone dialogue in the legal collection process. Here, I specified to Zwicker Associates dialers during purportedly recorded dialogue that the subject matter about which they were speaking to me was in litigation in Manhattan, over a period of several months. Yet Zwicker filed a Summons and Complaint in June 2013, and then a Notice of Discontinuance (rather than the appropriate Motion for Dismissal) one month later following several hours of work on my part to convince Amex and Zwicker that the subject matter was under litigation therefore illegal to file the complaint in a different venue. This is a blatant example of misappropriation of scarce resources in a law firm towards increasing profit rather than diligent practice of law. In a small firm (or a large diligent firm) where an attorney is keeping tabs on a matter entrusted to him as attorney for such matter, such attorney could not feasibly be told over several months that an account is in litigation but then go and commence an action purportedly on behalf of such client. Zwicker has misappropriated scarce resources in a manner unexceptable in the practice of law. Professional Responsibility in the practice of law may not be sacrificed as part of the operations stratgey of a firm. You cannot cost cut Professional Responsibility and continue to practice as attorney. Stephen Bann might say that his office is in Rochester and he was unaware of the information the debt collector callers at his firm had garnered when he commenced the action with a summons and complaint. If an attorney were actually representing a client in a subject matter at issue, the attorney would and should have had some sort of meeting of the minds as to the action with the client. Here the client is American Express. I need more information into how or why or what facet of Zwicker Associates operations was the impetus for the Rochester Office of Zwicker to commence the action. I have a similar criticism insofar as the Jaffe July Notice of Discontinuance, 27 months after my Affidavit in Opposition and two judicial decisions when it comes to scarce resources at a firm.

please also see Appendix 5 {Efile Doc 11), Appendix 9 {Efile Doc 17} and Notice of Discovery {Efile Doc 18} and related paragraphs for this Paragraph 14 re: Misallocation of Resources at Law firm to detriment of Diligence in the Practice of Law

15 As above in the description of the Jaffe CPLR 3217 filing, Zwicker appears, from a quick review of Zwicker cases in New York State Supreme Court, in the practice of filing Notices of Discontinuances well after the 20 day time period during which they are permitted by the CPLR to do so. In proximity to the time of the invalid filing, Zwicker is securing settlements based on false pretenses and without judicial review. Commencing a case in a court of law is not a frivolous undertaking, and, there are costs and risks associated with doing so which Zwicker is avoiding surreptitiously and illegally. As noted above, Zwicker has reduced the costs of their litigation by cutting costs associated with the proper, diligent, lawful practice of admitted, licensed attorneys in manner which are impermissible. The above Zwicker CPLR 3217 filing might, conversely, be considered a valid filing if in fact it came 20 days after service of a valid Summons and Complaint. But, the Zwicker filing is suspect due to a variety of reasons. To begin with, the Summons and Complaint was filed electronically- and the attorney who e-filed- Stephen Bann- has been e-filing in Suffolk County on a large number of cases. The same attorney has been e-filing the requisite form swearing that he has been complying with the e-file statute. When and if a Plaintiff sends a summons and compliant citing the authority of the State Court System, such plaintiff (Zwicker) must serve the electronic disclosure instructions on how to answer electronically. When such plaintiff does not do so, the mailing or whatever provision the firm usess to get the summons and complaint to the the defendant, without instructions, is pure harrassment alone- pure harrassment. OCA sanctions against Zwicker and Jaffe should take into consideration each and every electronic filing notice that goes with every filing on the OCA system; that is, again, Steven Bann for example, of Zwicker has probably on at least a thousand occasions signed the electronic filing document filed with court electroncially that he is complying with the efile statute and in the same exact filing is failing to provide efile instructions to defendants. This should be sanctionable, and, it is the impression of Rosenblum that no filing by Zwicker or Jaffe should be taken at face value until these violations are cured. As noted above, it appears that the majority of Zwicker revenues are the result of procedural decisions when in fact Zwicker is illicitly abusing the self-same procedure in a manipulative, deliberate, calculating manner. At the same time, it appears that Zwicker and Jaffe are using the same methodology to ensure that decisions are not had on the merits in consumer credit litigation they litigate. Rosenblum admits that this is a large allegation, but, for one thing, a preliminary review of Jaffe and Zwicker cases substantiates the allegation, and, as per above the Amex v Rosenblum cases should actually still be active therefore the allegations made by Rosenblum can be scrutinized in such matters in Suffolk and NY during the Discovery Process in both matters.

Affirmative, deliberate misrepresentation of the law by a plaintiff attorney during negotiation of settlement should not only be frowned upon, but, perhaps a sanctionable filing of instrument when erroneously used by a firm in the magnitude of the debt collection firms in question.

Again as to the actual validity of the above Stephen Bann/Zwicker Notice of Discontinuance, please note that Bann electronically filed a Proof of Service in Suffolk on July 3rd 2013, indicating service of process on the 28th of June. Note also that below I have made comment on the failure of Bann/Zwicker to provide an Index number or Form EFM-1. Note also that the Zwicker 3317 Notice is 7/22, one week following the 7/15 Jaffe 3317 Notice. In legal theory, even though the Jaffe Notice should also be deemed a nullity (it has not been yet- I assume it would need a judicial order), and if the Zwicker Summons and Complaint were deemed valid (albeit problematic in several ways including change of venue), then, the Rosenblum answer in the Jaffe action would be deemed timely served in the Zwicker action since the subject matter is identical, again invalidating the Zwicker Discontinuance not had by Order or Stipulation. Also, as a point of information, if the Zwicker 3317 was the only 3317 Notice filed by Zwicker in his practice, the 3317 Notice within 20 days of Service of Process might be construed as a legitimate attempt to end an action without ulterior illicit motives and therefore received at face value by a court. However, as noted, a review of the record will show that Bann/Zwicker is in the practice of filing 3317 Notices which the firm is ineligible to file and in the practice of using such sham to its advantage, illicitly, contrary to legal doctrine and ethics.

Note please as well that an important facet of the abuse in litigation by the above firms pertains to phone recordings and telephone practice and other technology in use by these firms....I have prepared two separate filings/webpages regarding telephone recordings and related issues in the above captioned cases. One such filing is a Notice of Discovery, one such filing is an Appendix to my Answer.

The Appendix to my Answer, {DMR#11} Appendix 9 of 18 REGARDING AMEX FIRM PHONE RECORDED EVIDENCE & COMMUNICATIONS TECHNOLOGY GENERALLY; FIRM/&LENDER OPERATIONAL COST&POLICIES SACRIFICING DILIGENT LEGAL PRACTICE. Efiled Document #17 can be reviewed by clicking here the Discovery Notice is in the next paragraph. , The page regarding phone recordings by Zwicker is still being worked on, but, here is the link to such page. The document is Efiled Document #17, {DMR#11} Appendix 9 of 18 to DMRAMEX091513 referenced in that document ¶ 16, and ¶¶¶¶¶¶¶¶¶ REGARDING AMEX FIRM PHONE RECORDED EVIDENCE & COMMUNICATIONS TECHNOLOGY GENERALLY; FIRM/&LENDER OPERATIONAL COST&POLICIES SACRIFICING DILIGENT LEGAL PRACTICE.

The related "Notice of Discovery and Inspection , Efiled Document # 18 "CPLR 3120 Zwicker and Amex Phone Records, Recordings and other communications by Amex and Zwicker in relation to the subject matter at issue in the captioned matter(s) Amex v Rosenblum", which Notice of Discovery can be viewed on the web by clicking here, and is efiled as {DMR#12} NOTICE OF DISCOVERY CPLR 3120 Zwicker and Amex Phone Recordings and Communications by Amex and Zwicker; re: subject matter at issue in Amex v Rosenblum. Notice of Discovery , Efiled Document #18. Referred to in DMRAMEX091513 ¶16, 15 ¶, and ¶¶¶¶.

Note that Rosenblum intends to follow up on this request for related Discovery request such as the included Discovery of Operational Policies related thereto in the above captioned matters.The Appendix 9, Efiled Document # 17 and Notice of Discovery, Efiled Document # 18, are therefore intricately connected. And, to be certain, intricately connected to all paragraphs in todays Informational Supplement to my Answer, especially in light of the title of this section numbered as paragraphs 15 and 16 above, 17 et al below, and related information today presented, which as such supports the Notice of Discovery in the Suffolk Index commenced by Zwicker until such time that the action is properly resolved.

Zwicker offices have made informed, deliberate actions to circumvent requirements of Professional Conduct. Zwicker offices have devoted technology to record calls and monitor data on the collection side but have taken efforts to cut costs insofar as diligent filing by not applying the same technology and data analysis to filing diligently. The more sophisticated technologies of data analysis at Zwicker are devoted to non-legal facets of the firms' operations. Instead, the Zwicker firm has calculated that it is better off filings actions without diligence because of cost factors. However, diligence is not a cost factor which an attorney is entitled to minimize especially when such attorney has operations in place such as Zwicker. Zwicker claims to be recording calls and verifying identity etc thousands of times a day but is filing actions without the commensurate utilization of technology as with the collectors. In addition, whereas all dialogue with a collector is subject to verbal analysis, none on the attorney side is.

Amex guilty of same thing. For example, Amex is in a positoin and has facilitated systems of data analysis whereby upon submission of social security number can analyze data from major credit reportig bureaus and extend credit or not instantaneously based on accurate information which comports with cost benefit analysis. But when it comes to required legal dilignece inn filing of actions, no such system to call upon or request information, utilied beofre a filing. Such diligence is a REQUIRed cost ,, not to be shirked and not to be lawfully trimmed to increase profit margin. The instant Zwicker debt collectors speak to a target, all recorded and information towards Zwicker's end- profit; n such system to comply with law. Zwicker is a sly operation, does not deserve to use the attorney monicker in solicitations. Diligence in legal filings, specifically to commence actions against individuals, is not to be trimmed in cost cutting for an attorney operations.

Here, specifically, Rosenblum notified Zwicker collectors on several occasions of the Index at 60 Centre Street, instances when told all info to collect a debt, attorney firm, all recorded. For months Rosenblum stated the same. Still, Zwicker commenced an action. If Zwicker had simply had in place a system for collectors to verify simultaneaous actions, would not do so. If claim is that the exercise would make the business cost prohibitive, so be it- don’t enter the business. Plenty of other areas for attorneys to operate as legitimate attorneys.

Note that the American Express data processing model is identically problematic. A true data processsing busiess not a BHC would lserve its customers processing data which the customer- the general public- desired and was willing to pay for. The BHCs have cornered the market and stymying innovation. All costs cut to processor's advantage, with safety net of TARP and deposit insurance on lending of percentage on deposit plus tying of data processing service, a guaranteed revenue stream. This hurts the business of banking as engine of growth in capitalism.

Variously throughout my Septemeber 15th 2013 I refer not only to some problems I see in consumer credit and debt collection attorney firms (specifically I refer throughout to abuse of law and legal process and abuses of the CPLR and NY Model Rules), however also throughout my September 15 filing I refer to solutions to those very same problems- discussed throughout in what I variously refer to as a 21st Century Digital Banking Critique or Analysis. The abuses by the firms are independent of the proposed models for resolving such problems- at a minimum a suggestion of how to resolve the firm errors.

That each firm cease and desist from recording calls for any purpose. That each firm cease and desist from using call recorded evidence or as a bargaining tool until such time that all parties are on a call to be recorded are given the option to review and archive any such calls on par with the recording party, and given the option to record any call made by the entity proposing to record such calls.

Here, such calls are defined as any and all verbal communications between the entity and the party. Here, such calls between entities and a party is defined as any communication what so ever between, for example, American Express and it's customer, and also any verbal communication between any representative of American Express such as a law firm including call centers, operators, etc.-, and all employees of the law firm. This includes operators paralegals attorneys and call center employees.

Otherwise, use of a single recording as evidence is contrary to the Rules of Evidence and is Unconstitutional.

Assess a $50 or $ 100 fine per violation of a recorded by Jaffe or Zwicker until such time that there is equity in call reporting . The Stephen Bann Zwicker Associates Suffolk County Summons and Complaint against Rosenblum should be deemed harrasment alone against Rosenblum upon review of call recordings between Rosenblum and Zwicker. On several occasions of recorded calls between Rosenblum and Zwicker call center dialers Rosenblum gave notice to Steven Bann's law firm of the Jaffe New York County litigation, in process since early 2011. In addition on multiple occasions Rosenblum spelled out his situation to American Express and multiple collect collection agencies.

17 Paragraph on Sanctionable Actions by Zwicker and Jaffe; New York Office of Court Administration; Note on Form EFM-1 and Uniform Rule 202.5-bb In the opinion of Rosenblum, here, both Zwicker and Jaffe should be sanctioned by the Office of Court Administration for every instance that one of two things occurred. One, filing a notice of discontinuance during the time period that only the defendant is entitled to file the stipulation of discontinuance, and, two, every instance that a summons and complaint is served to a defendant without instructions for efiling and instructions for indication of receipt of service of process.

Diligence required in filing of actions.

When and if a plaintiff sends a summons and complaint citing the authority of the state court system, such plaintiff must serve the electronic disclosure plus the instructions to answer as per 202.5-bb Electronic Filing in Supreme Court; Mandatory Program of the Uniform Rules for N.Y.S. Trial Courts and must serve Form EFM-1. When such plaintiff does not supply an Index number, a Form EFM-1, or related documentation, the mailing, the service by process server or whatever provision is used to get the summons and complaint to the the defendant, without instructions, is pure harrassment alone- pure harrassment. I will affirm by notarized affidavit that I was not given any notice that the case was efile until a phone conversation with Stephen Bann around the time he emailed me the Notice of Discontinuance he had efiled, which I believe to be a nullity. The sanctions against Zwicker and Jaffe should take into consideration each and every electronic filing notice that goes with the S and C on the OCA system; that is, again, Steven Bann for example, of Zwicker has probably on at least a thousand occasions signed the electronic filing document filed with court electroncially that he is complying with the statute and in the same exact filing is failing to provide instructions to defendants. This should be sanctionaable, and, it is the impression of rosenblum that no filing by Zwicker or Jaffe should be taken at face value until these violations are cured.

The above referred to violations and misuse by Zwicker is even more blatant and absurd given that on the efiling system, after every filing made, the system prompts the user with a paragraph stating "e-Filing Notice: You must print a Notice Regarding Availability of E-Filing to serve on each party that has not consented OR in a mandatory case, a Notice of Commencement of Mandatory E-Filed Case. " Along with such paragraph, there is a button to click on which gives the attorney, in this case Steven Bann, a copy of the Notice Form- yet- Steven Bann is not attaching the Notice to his commencement of actions, a review of his cases shows that. Again, Rosenblum indicates that Zwicker has operational policies to increase the default judgments, which policies have used a cost-benfit analysis to minimize diligence and professional responsibility and increase firm profits. All Zwicker filings in the State of NY should be taken with a grain of salt, and, the firm should be sanctioned and perhaps put on "probation" for these blatant violations and misuse of legal practice. This "strategy" by Zwicker did not happen just once. A review of the record will show myriad examples of the same abuses. Between the violations in commencing actions and in purported discontinuance of actions, the Zwicker firm seems to operate in a manner that they can turn a blind eye to the CPLR and OCA Rules and Regulations as it pertains to the start and finish of court actions, all the while the Zwicker attorneys will march into court demanding default judgments when the time period defined by the same canon of laws rules and regulations expires, and then Zwicker seemingly laughs all the way to American Express and the bank while defendants wages are garnished or impoverished defendants plead for mercy and forgiveness given an inability to pay due to harsh economic times and manipulative, predatory practices which can be reviewed by opening a number of Zwicker cases and reading the case file.

Further, the home page of the Efile system contains the following paragraph: "REMINDER to Serve the proper EFiling Notice upon CommencementE-Filing rules require that a party commencing an e-filed action must serve a hard-copy notice regarding electronic filing with the commencement documents. The specific type of notice depends on the nature of the e-filed action. In a mandatory e-filed action, the commencing party must serve the Notice of Commencement of Action Subject to Mandatory Electronic Filing (Form EFM - 1). In a consensual e-filed action, the commencing party must serve a Notice Regarding Availability of Electronic Filing (Form EF - 3). The NYSCEF system will offer you an opportunity to print the proper notice on your success page after filing your documents. Both forms are also available on the Forms page which is located under the Resources tab." Steven Bann and Zwicker, and other Zwicker attorneys, are ignoring the paragraph, much like they ignore paragraphs in the CPLR. Note that Rosenblum understands that in the instant matter at bar, Rosenblum recognized the service of the Zwicker summons and complaint but had no knowledge of the Efiling system until a conversation about the Discontinuance after it was filed on July 22. By that time, Rosenblum had engaged in at least 15 conversations with Amex Zwicker and Jaffe about the June 20th Zwicker commencement. Apart from the 15 conversations, Rosenblum had processed at least 20 pages of varied documents and additional notes. Further, Rosenblum had answered in NY County on Index # 100156/2011. The point here is that the Zwicker failure to provide the Efile instructions worked to give Zwicker an "option" to file a Discontinuance seemingly perhaps in compliance with the CPLR 3317 requisites. But again, Zwicker is looking to have the letter of the law enforced in one statute but not in others, abusing the system. Rosenblum agonized from receipt of the Zwicker Summons and Complaint for several weeks as to how he would make filings in the matter in Riverhead given he has no automobile and works full time. Rosenblum spoke with Suffolk County Supreme Court and County Clerk on multiple occasions prior to the Zwicker 3317 Notice in an effort to figure out how he could file his answer, not knowing it was an Efile case. Here, Rosenblum would have easily and readily filed an answer electronically well before the Zwicker 3317 Discontinuance if Rosenblum had known the case was Efile. The Zwicker filings seem to be pure deliberate harrassment, and, Rosenblum is of the understanding that the Zwicker Discontinuance should not accrue to Zwicker benefit in this case or any other. Rosenblum alleges that Zwicker has negotiated a plethora of Settlements on behalf of American Express which should be invalidated in instances that Zwicker has failed to commence or terminate actions properly. In each such action, such cases should necessitate- retroactively- Judicial Orders or Stipulations of Discontinuance. Such Judicial Orders should carry sanctions and reprimands against Zwicker. Monies exchanged to American Express resultant such settlements should be refunded to payors, and all such settlements should be re-negotiated in light of the law.

While DMR (in writings in this matter Daniel M Rosenblum will refer to himself variously as "DMR", "Rosenblum", "Dan") states variously in filings in the instant matter that he is of the understanding that the 3317 Notices of Discontinuance might be deemed "nullities", Rosenblum believes that the fact that both firms made such filings should bear weight with the court. In fact, in one regard, the instance of two Discontinuances by a Plaintiff in identical subject matter might be construed as an ajudication. However, Rosenblum is of the understanding that it has not yet been determined whether the Discontinunaces are valid or not, and, there are several issues which Rosenblum is of the opinion have been brought to bar in the instant matter which merit analysis before a hasty ajudication prior to deliberation as to whether and why the Discontinuances are valid or not. Thus, Rosenblum would appeal an ajudication based on the two Discontinuances without a determination as to the validity of the Discontinuances because, as indicated, such discontinuances are seemingly nullities but that remains uncertain as there has been no judicial review of the Notices and they seem to be blatant corrupt tactical maneuvers by firms with ulterior motives. In the end, Rosenblum desires a "just" result in the instant matter, and is of the understanding DMR has the inherent right to such a just result in the instant matter in New York State Supreme Court, Suffolk County.

in the instances where the discontinuances have been filed, it is not unreasonable to assume that the plaintiff attorney has mislead the defendant with regards to the significance of the instrument. And, the simple fact is that where generally speaking yes, the burden is on the defendant to understand the law and to put forth one's rights in court; but, the affirmative action of the plaintiff attorney in filing the nullity instrument repeatedly in case after case is one where/that shifts that burden. And where the court has moved cases' status to 'disposed'- even though that is perhaps an internal record-keeping status internal to the court with regards to indices assigned to a judge perhaps, but, the status shift should probably only occur following judicial review or some mechanism which comports with the CPLR, not a nullity. If the legislature wants to change the CPLR and allow Notice of Discontinuance at any stage in litigation, the legislature can deem Notice of Discontinuances to be effective when filed by Plaintiffs at any stage of litigation. Thus far, the legislature has not passed such law. Rather, the legislature passed CPLR as writ. At common law in the 18th Century, a Plaintiff was permitted to dismiss a case voluntarily without prejudice anytime prior to judgment. Today such right to dismissal is governed by rule or statute. Most jurisdictions reject the common law approach recognizing the burden on a defendant of a civil suit. An appearance alone does not constitute a burden on a defendant, but, an answer does. "defendant" and "answer" in this regard, is a sort of universal concept in the debt collection practice. These firms function as machines, and, where there are answers are removing the "burden" associated with litigation universally by filing the instrument they are not entitled to file, claiming that there's no issue remaining in the litigation and that the status should shift to 'disposed' because the plaintiff so desires, and indicates to the defendant in negotiation that legitimately the legislature has recognized that common law approach when the legislature has not done so. There is expense to the court system when litigants repeatedly file cases with the knowledge that they can at will dismiss cases without the cost to the plaintiff of appropriate adjudication of ALL cases files even if not in the interest of the plaintiff.

While there is privity in an action, all compulsory claims must be asserted by defendants; plaintiffs action in filing the discontinuance notices and belie-ing the significance of the instrument in negotiations works to minimize compulsory counterclaim suits in a percentage of actions where compulsory counterclaims would tend to arise or be recognized during t he course of actual litigation and adjudication and is therefore unjust. The cases should remain active, and, it would become apparent that these plaintiffs are over-utilizing the court's resources in an unjust frivolous manner. The burden of such cost should be resolved at the front end of making loans, not absorbed by the courts resources piling as a burden of active unresolved cases. Plaintiffs can secure Stipulations as part of their business model, but, such Stipulations in instances of settlements for money to a lender should not carry the additional "waiver and release" regarding the lender and lender's attorneys, absolving the attorneys and lender of any wrongdoing related to the litigation for perpetuity circumventing proper adjudication costs and the law in general but commencing the action using the authority of the state court system. That is a calculate way to circumvent the law and minimize liabilities associated with such litigation and can be construed as intended harassment by such plaintiff firms.

especially where plaintiff's attorneys do that in proximately to a settlement and misrepresent the significance of the instrument. To be certain it is important for the judges' chambers not to have a pile of unresolved actions. but, in the consumer credit civil claims, defendants do not have a right to an attorney, and defendants oftentimes find themselves in court on the one instance in their lives. There is a problematic repetition of the same maneuver and tactic and strategies, there are few ways to reconcile it, this is one suggested manner to reconcile. another might be to have CFPB act as attorney in these cases. But bear in mind that here, presently, litigant Rosenblum is not litigating to be a protector of debtor's rights; nor do I advocate some procedural maneuver to circumvent obligation by any party; rather, I litigate and advocate insofar as the data processing industry is concerned and DMR's rights as sole proprietor of the business entities 21st Century Digital, TTS Industries, and TMTP USA Unlimited. As such, I advocate an analysis in the marketplace which considers in detail two fundamental banking regulatory axioms- tying in banking, and, permissible activities in banking. And I analyze here now- critique in part here now- insofar as the law goes- the attorney firms litigating on American Express' behalf given privity in an action. Please see the 20 Series of Paragraphs § ¶ 20.4 ¶ 20-22 below for further articulation of the 21st Century Digital Analysis and Critique as it pertains to Banking, Regulation, Permissible Activities, and Tying.